There is a fascinating idea in personal finance that has the ability to turn modest investments into enormous riches over time. Compound interest is the cause of this financial phenomenon. Understanding and using the power of compound interest can be a game-changer in reaching long-term financial goals, despite the fact that it may seem like a difficult concept. In this article, we will delve into the idea of compound interest, examine its amazing wealth-building potential, and learn Warren Buffett’s success formula.

Understanding Compound Interest:

Let’s think about a straightforward scenario to better understand compound interest’s genuine impact. Consider putting $1,000 in a savings account that pays 5% return annually. You would receive $50 in interest at the conclusion of the first year, bringing your whole balance to $1,050.

Here is when the strength of compound interest is put to use. You opt to let the $50 accrued grow in the account rather than taking it out. The interest is computed in the second year not only on the initial $1,000 but also on the extra $50 from the first year. You would earn $52.50 in the second year at 5% interest, bringing your whole balance to $1,102.50.

As you can see, your balance increases as a result of both the collected interest and your initial investment. The growth gets more significant the longer you keep your money invested and reinvested the interest. This compounding effect has the potential to produce exponential growth over time, greatly boosting the return on your investment.

This example illustrates the idea on a smaller scale but when more expenditures are made over longer periods of time, the impact is much more striking. Compound interest is a great tool for reaching your financial objectives since it has the ability to create significant wealth over time.

The Significance of Time:

When trying to use the power of compound interest, time is a key component. The compounding impact gets more evident and the potential for wealth accumulation increases the longer your money is invested. To fully benefit from compound interest, investments should be started as soon as feasible, according to the “time value of money” principle.

Let’s think about two instances so that we may better comprehend the value of time. Let’s name the person in the first scenario Person A. Person A begins investing $5,000 annually at the age of 25 and keeps doing so until the age of 35. Over a ten-year period, they invest a total of $50,000. The second scenario is Person B, who begins investing the same amount, $5,000 annually, but waits to start until she is 65 years old. Over the course of three decades, Person B contributes a total of $150,000.

We can contrast the results of Persons A and B’s investments assuming that both earn an average annual return of 7%. Person A invested $50,000 in total, which would have increased to almost $602,070 by the time they were 65. However, Person B’s investment would have totaled about $540,741 with a total contribution of $150,000.

Even though Person A invested only a third of what Person B invested overall, Person A’s investment balance upon retirement was much higher. The benefit of time and the extended time for compound interest to work its magic are the main causes of this glaring disparity.

This example demonstrates the importance of getting started as soon as possible and giving investments more time to compound. With time, the compounding impact intensifies, boosting the growth potential of investments. You position yourself to profit from this compounding growth and optimize the potential wealth creation by starting investing sooner rather than later. Boy did I wish I knew about this in my early 20s.

The key takeaway is that time is indeed a valuable asset when it comes to compound interest. The earlier you start investing, the more time your investments have to grow, potentially resulting in a significantly larger nest egg in the long run. Whether it’s for retirement, education funds, or any other financial goal, leveraging the power of time and compound interest can be a vital strategy to achieve financial success.

The Rule of 72:

The Rule of 72 is a straightforward yet effective method for calculating how long it will take an investment to double at a specific interest rate. You may get a ballpark figure of how many years it will take for your investment to double by dividing 72 by the interest rate. If your interest rate is 8%, for instance, it will take roughly nine years for your investment to double (72 x 8% = 9).

This guideline offers a quick and practical way to evaluate the potential for growth of your investments. It draws attention to how compound interest accelerates the buildup of wealth over time. By comprehending the Rule of 72, you may make knowledgeable financial selections and establish reasonable expectations for their performance.

It’s crucial to keep in mind that the Rule of 72 is only a rough estimate and implies a steady interest rate. In fact, investments’ returns may vary from year to year and interest rates may change. Nevertheless, the rule emphasizes the importance of compound interest in achieving long-term growth and is a useful guide for determining how long it takes assets to double.

Embracing Long-Term Investing:

Compound interest has several benefits, but one of the biggest is the opportunity for long-term investing. By taking a long-term approach, you put yourself in a position to benefit from continuous and sustained growth. Long-term investing emphasizes the creation of wealth over an extended period of time rather than searching out rapid returns or trying to time the market.

Reinvesting your money is a crucial component of long-term investing. You let your investments’ gains grow over time rather than taking them out right away. You can efficiently use compound interest by reinvested dividends, interest, or capital gains back into your investments. Due to this, even little recurring payments might eventually add up to substantial sums.

It’s critical to have a disciplined approach to long-term investing in order to realize its potential. This entails sticking to your investing plan despite market gyrations and resisting the need to take hasty decisions based on passing trends. You may block out the noise of short-term market volatility and concentrate on the long-term growth potential of your investments by keeping a long-term outlook.

Utilizing tax-advantaged accounts is an important component of long-term investing. Tax advantages are provided through retirement accounts like individual retirement accounts (IRAs) or employer-sponsored plans like 401(k)s, which can dramatically increase the profits on your investments. By using these accounts, you can postpone paying taxes on investment gains and possibly experience tax-free growth, allowing your investments to compound more successfully over time.

Warren Buffett’s Enigma:

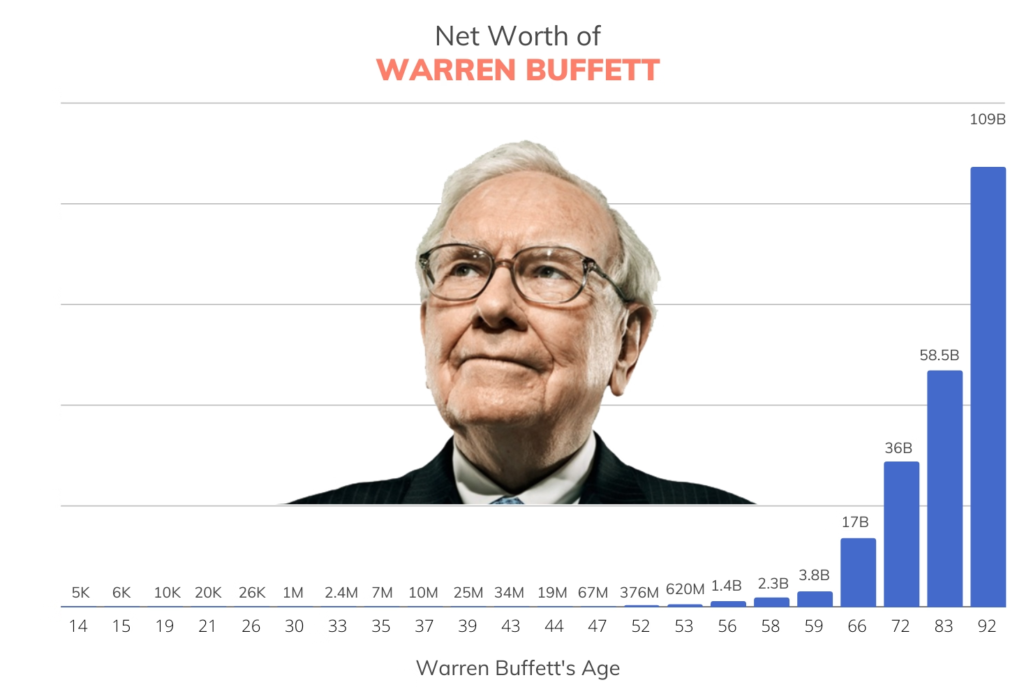

One of the most successful investors in the world, Warren Buffett, frequently credits compound interest for his success. His approach to investing focuses on finding undervalued businesses with room for long-term growth and holding onto them. Buffett has made remarkable profits by reinvested dividends and letting his investments grow over time.

Buffett started investing when he was 11yrs old. He adopted the “buy and hold” mentality at a very young age. Now in his 90s, he has now invested for over 80 years! We’ve had Depressions, World Wars, multiple Bubble bursts and most recently even a Pandemic. Buffett continues to be heavily invested in the market. He embraced the true power of Long Term Investing that capitalized compound interests. In fact, 99% of his current Net Worth came after his 50th birthday.

Buffett’s strategy incorporates the fundamental ideas of compound interest. He promotes a long-term investing strategy and emphasizes the value of perseverance and patience in keeping onto top-notch businesses. Buffett is aware that the compounding effect has the potential to dramatically increase the value of his assets, making patience and self-control essential ingredients in his winning formula.

Takeaway:

Over time, compound interest has the tremendous ability to turn little investments into large fortunes. You may take advantage of compound interest and pave the road to financial independence by starting your investments early, adopting a long-term perspective, optimizing returns, and exercising cautious debt management. The key to Warren Buffett’s success is his steadfast belief in compound interest’s power and his ability to grow investments over time. You can create a wealthy financial future by following a similar strategy and utilizing the power of compound interest. In the quest of compound interest, keep in mind that time is your best ally. Start making smart investments now to realize the incredible possibilities it offers for your future.

In future blogs, we’ll illustrate automated ways you can setup to mindlessly invest a certain amount every month. Your future self will thank you.