Buying a new car is often an exciting prospect, with the allure of modern features, sleek designs, and that unmistakable “new car smell.” We’ve written how this is seemingly more prevalent in the Asian communities. However, many fail to recognize the opportunity cost associated with this purchase. We’ll delve into the true cost of buying a new car and highlight the potential gains that investing in the S&P 500 can bring.

The True Cost of Buying a New Car

There are obviously many different scenarios that affect calculating the true cost. For this study, we’ll just be looking into the act of buying the car and not the total cost of owning the car:

- A new car replacement – meaning the person already has a car but looking to replace it

- Average Cost of New Car – $48,000

- We will not be accounting for Gas, Insurance, Parking, Yearly Taxes and Maintenance.

With an average new car of $48,000, assuming you put 20% down and financed the rest of the car with a 5 year loan with a 5% interest. After 5 years, you paid a little under $55,800. Over $5,300 of that is interest.

| New Car | $48,000 |

| Tax (4.99% average for US) | $2,395 |

| 20% down from Car cost | $9,600 |

| Amount Financed (Car + Tax – Down) | $40,795 |

| Total Interest Paid (5yr at 5%) | $5,396 |

| Total Cost to Purchase | $55,791 |

Once again, we’re just looking at the cost of purchasing the vehicle. For investment purposes, we all know that a good majority of the cars lose value extremely fast and up to 20% the first year alone.

Now let’s see what would happen if we didn’t buy the car and responsibly invested the money instead!

Opportunity Cost

Opportunity cost refers to the potential benefits that are foregone when choosing one alternative over another. In this case, when you decide to buy a new car, you’re forgoing the opportunity to invest that money, potentially resulting in lost future earnings.

Opportunity cost = Return on best option not chosen – Return on option chosen

In our example, the return on best option not chosen is investing the money. The Return on option chosen is actually paying money so it’s a negative. Hence:

Opportunity cost = Return on Investing – -Paying money for a car (A double negative, so we add)

Let’s break it down:

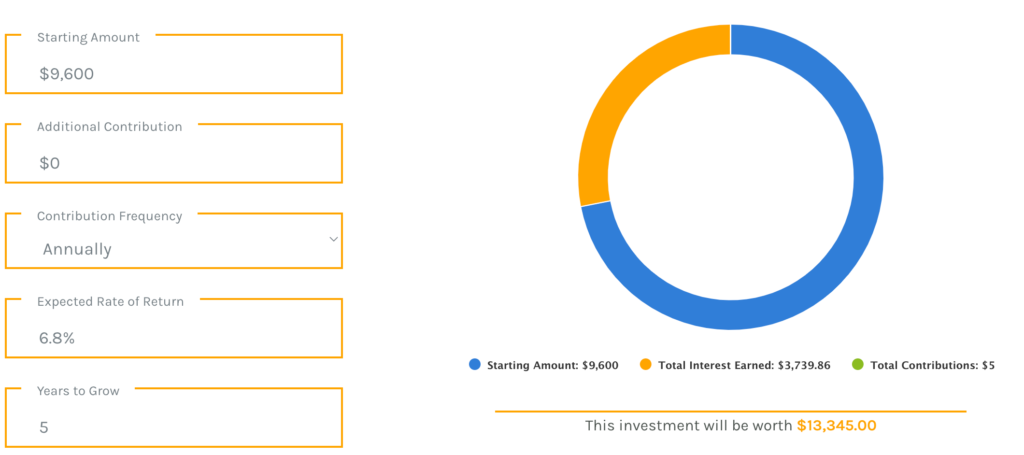

Initial Down Payment – Invested

Using the example stated above, we see that a down payment of $9,600 was made initially. What happens if that amount was invested instead in a conservative 60/40 strategy that has an average interest of 6.8%.

After 5 years, that $9,600 turns into $13,345 ($3,740 earned interest).

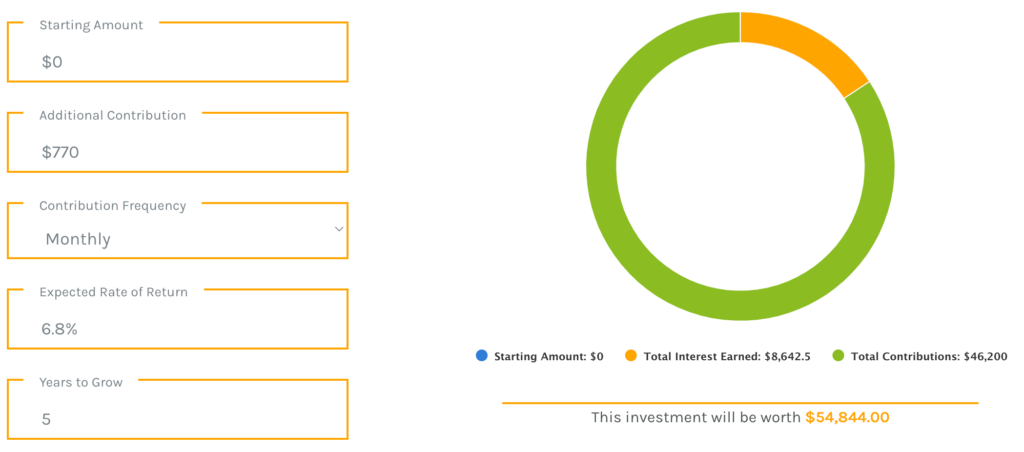

Monthly Payments – Invested

Continuing with the example used above, we see the monthly payment for the car is $770 a month for 5 years. What happens if that amount was invested monthly using a conservative 60/40 strategy that has an average interest of 6.8%.

After 5 years, those monthly payments will be worth a little under $54,900 (over $8,600 in earned interest).

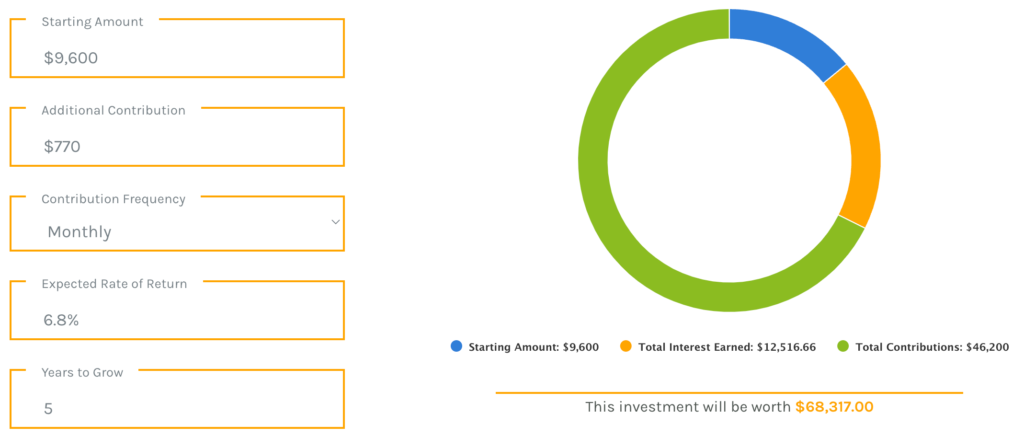

Down Payment and Monthly Combined – Invested

To combine the down payment and the monthly payments into an investment, your portfolio after 5 years at 6.8% would result in over $68,000 ($12,500 in earned interest)!

Opportunity Cost of a New Car

Recapping all of these numbers and providing a tl;dr: by foregoing investing the money and instead using the money buy a new car, the opportunity cost is:

68,317 – -55,791 = $124, 108!

Investment amount – –combined payment = Opportunity Cost (minus a negative is adding)

We hope you really love that car!

The glaring omission is that we just ended the investments after 5 years. Let’s say you no longer contributed monthly and just left the portfolio alone for 20 years. The $68k now turns into nearly $255,000!!

Takeaways

While purchasing a new car may seem like a rewarding experience, it is crucial to recognize the opportunity cost associated with this decision. We’re not saying that nobody should buy cars. We understand a car is often required for transportation. We’re just suggesting less extravagant cars or perhaps used cars. We’re also assuming you prescribe to a respectable financial literacy plan, like the HutYee Way where you are managing your money properly.

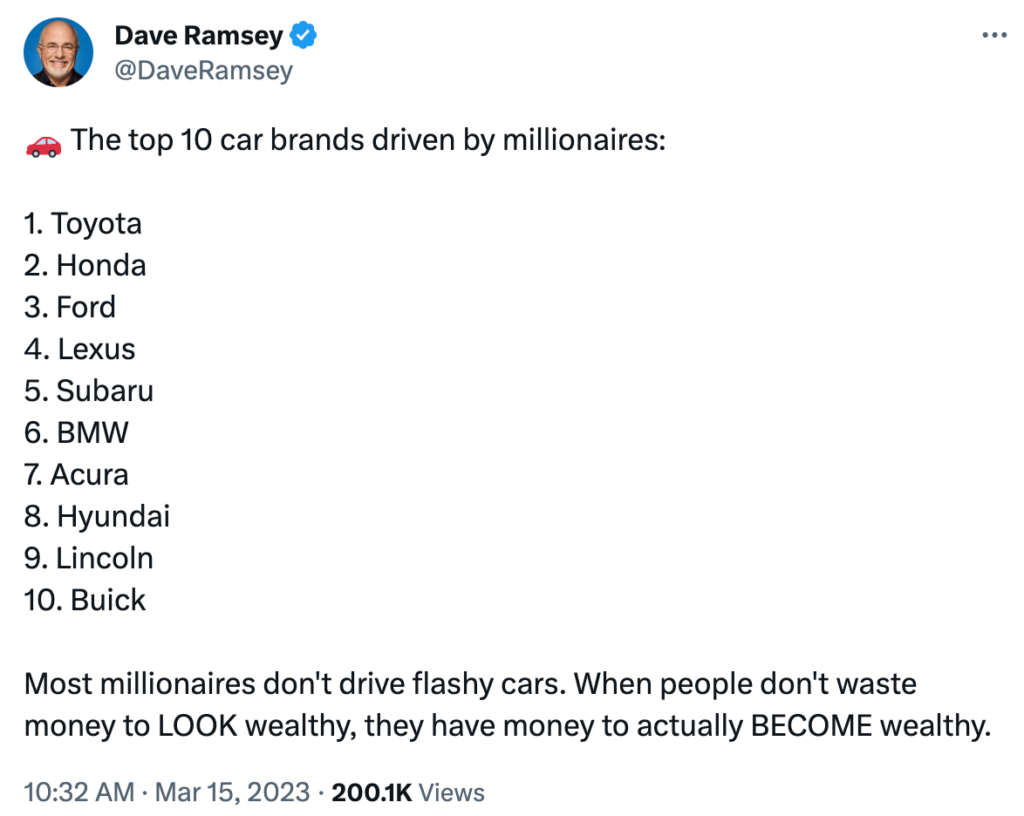

Dave Ramsey’s tweet we believe sums it up.

When people don’t waste money to LOOK wealthy, they have money to actually BECOME wealthy.

@DaveRamsey

We would like to emphasize that we are not financial advisors. The information provided on this website and in our YouTube videos is strictly for educational purposes and represents our personal opinions. To ensure the most appropriate financial decision for your specific needs, it is essential to conduct thorough research and, if necessary, consult with a licensed financial advisor. It is important to acknowledge that all investments involve inherent risks, and there is no guarantee of success in generating, saving, or investing money. Additionally, there is a possibility of experiencing losses when investing. It is crucial to exercise prudence, make informed choices, and independently verify information.