I wrote this 3 years ago (2020) prior to the existence of this blog hoping to really spread the word of how important I think investing is. I read it over and luckily I still find the content true. This article in combination with my previous article about compound interests when followed, your future self will thank you.

Introduction

We’ve all heard the saying “Money isn’t everything.” While that is certainly true, I would also add that without money, you’re nothing. Apologies in advance for my brutal belief.

In my humble opinion, having financial stability means the world to me especially during retirement. In my ideal world it would consist of:

- You and your partner living a long, happy and healthy life

- Being financially independent till your last days and not relying financially from your next generation/loved ones

- Perhaps leaving something for your loved ones when you pass.

Now does having money solve all of those? No, but I can pretty much guarantee NOT having money gets you none of those.

So what does it take to have financial stability?

Please note that I am not a Financial Planner. This article also assumes that you do not own a business. Having a business (especially a successful one) changes everything.

Challenges we face

How much is your dollar worth in retirement?

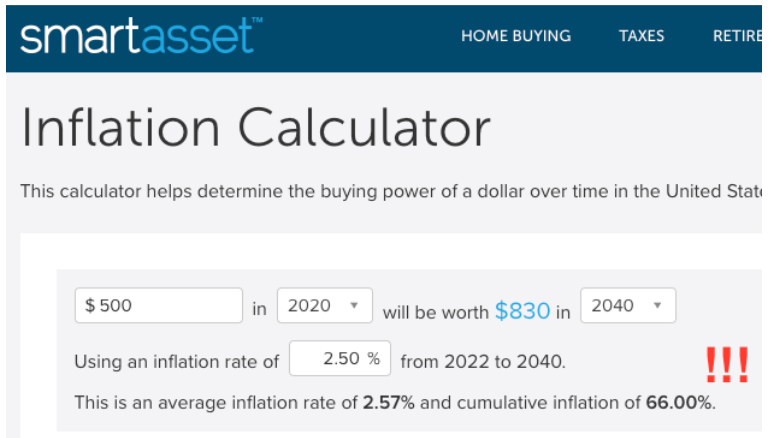

Inflation is the big bad villain that’s magically making your money essentially worth less. On average the annual inflation rate is ~ 2.5%.

If you think your average cost of living could be for example $500/mo in 2020. In 2040 (roughly when I retire), those essentials will now cost over $800/mo.

If I’m lucky enough to stay retired for 20 years, in 2060 that $500/mo in 2020 turns into over $1350/mo!

My 401k is huge, isn’t that enough?

Congrats that you’ve accomplished in building a large 401K portfolio! Perhaps you even added on a large IRA account as well, double congrats!

BUT…. as you saw above with inflation, what might seem large in 2020, looks kinda small in 2040 and even smaller in 2060.

Another contributing factor is how long you’ll live. With the advancement in medicine and technology, life expectancy has increased annually.

Life expectancy back in 1970 was early 70s. For 2020, the life expectancy is increased to 79.

Life expectancy in 2050 will be 83. Remember that 83 will be the average, what if you’re above average and live till 90+? Will your 401k and IRA last for 25 years?

Finally, remember most 401K and IRA (traditional) are tax deferred. Meaning when you retire and withdraw from them, Uncle Sam will want his cut and who knows what the tax rate will be then. At the time of this writing, the highest tax bracket you can be is 37%. Did you know that the average rate for the highest bracket in the past 100 years is close to 58%?

Ideal Situation

So how do we deal with 1. Cost of living rising and 2. Not knowing how much you really need? While it isn’t an exact science the below steps help to achieve your goals.

Make your 401k HUGE

Try to max out as much as possible (at the minimum up to your match) your yearly 401K and grow the account as much as possible by selecting a little more aggressive fund allocations until you’re at the age of 50-55. Then lower your risk after 50-55. While I’ll tell you the SPY (S&P500 index ETF) averages 10% a year, there are Black Swan events like the Dot Com crash and the Financial Crisis which dropped the market and took multiple year to recovery. So having your 401K portfolio that’s safer in the last 10 years of your career removes a lot of the risks.

Remember that withdrawals from your 401K are subject to tax.

IRAs

IRAs in some ways are better than 401Ks because there’s a large variety of ways to invest as opposed to 401Ks oftentimes have very limited options and the fees are typically higher. There are many requirements to be qualified for IRAs but in general, the below should work for you. Of course, please do your own due diligence to make sure.

Traditional IRAs

At the time of this writing, if you are married and filing jointly and have an Adjusted Gross Income below $125,000/yr, you can open a traditional IRA for $6000/yr and deduct it for that year’s tax. This is great that you’re deducting $6k from your taxes for that current year. But keep in mind, similar to 401Ks, withdrawals in your retirement years are subject to tax.

ROTH IRAs

The primary advantage for ROTH IRAs is that withdrawals in your retirement years are tax free. The disadvantage is that you have to use money that’s already taxed to open such account. At the time of this writing, if you are married and have an Adjusted Gross Income below $198,000/yr, you can contribute $6000/yr to your ROTH IRA (as of 2020).

Backdoor ROTH IRAs

Love the tax free benefits of ROTH IRAs but making more than $198k? First off congrats! You can still legally have ROTH benefits and make more than $198k by doing a Backdoor ROTH IRA. It’s a loophole that is created by first contributing to a traditional IRA and then immediately converting it to a Roth IRA (to avoid paying taxes on any earnings or having earnings that put you over the contribution limit).

Like always, please consult with a tax accountant to be sure.

Lifetime Income

Wouldn’t it be great if you get a check every year during retirement until you pass? Social Security is intended to do this however let’s be honest, the amounts of those aren’t the greatest and there’s been rumors for years that it’ll eventually go away. So let’s not count on that.

Pensions

Way more prevalent in the past but there are still jobs that offer pensions where they provide (typically a percentage based on your tenure and compensation) a monthly check for life. Jealous? However, remember the inflation challenge written above? Can your monthly checks cover your monthly costs if they rose by 60% or more than double?

Annuities with a Lifetime Income Rider

Annuities are investment plans typically sold by insurance companies. I’m no expert in this field but annuities today can be built with:

- Capital appreciation when the markets go up

- Principal when the markets go down. Meaning your account never drops unless you withdraw

- When it’s time to start yearly withdrawals, it can have amounts that increase every year until you pass

- Rollover 401Ks and IRAs can contribute to this

- Unused amounts are distributed to your beneficiaries

Dividend Investments

If you ever look at Warren Buffett’s investments, you’ll notice that he typically only invests in companies that pay annual dividends for just owning the stock. Buffett invested $1.3B in 1994 to purchase Coca-Cola and has earned $7B in dividends as of 2019 for just buying and never selling.

There are many ways to build such a portfolio but I find most effective to:

- Select a handful of dividend stocks

- Contribute an amount every so often (monthly, quarterly, yearly, etc) till you retire

- Have dividends reinvested until you retire

- Take out dividend earnings when you retire essentially for the rest of your life

Many people actually pass on the entire portfolio to their kids so they get a lifetime income.

You are taxed on your dividend income annually but at long term gain rates as long as you’re not selling your stocks.

Conclusion

I hope I’ve illustrated the importance of investing and building financial stability. There are still other things that I haven’t mentioned like life insurance, college planning, long term care and estate planning to avoid probate taxes that are equally important. In general, there are no one-size fits all methods. Personally having multiple streams of income during retirement is what I’m striving for. IE 401k with Annuities and Dividends.