I admit, when I first found about this book I was most likely click baited by the title of the book. But as I started reading the book, I found tremendous value in the teachings. Ramit Sethi’s book, “I will Teach You to be Rich,” offers a thorough road map for achieving true wealth in a society where financial independence is a highly desired goal. Sethi gives readers the tools they need to take charge of their financial future with his special blend of psychological insights, practical advice, and tested strategies. Below are some of the key lessons I got out of the book.

Not only is Ramit Sethi the author, but he also has a YouTube Channel as well as a series at Netflix called How Get Rich.

Shifting your Mindset

Unlike many personal finance teachings where frugality is taught as the end all be all to everything in life. Sethi has a slightly approach where he encourages everyone find their passion.

Frugality isn’t about cutting your spending on everything. That approach wouldn’t last two days. Frugality, quite simply, is about choosing the things you love enough to spend extravagantly on— and then cutting costs mercilessly on the things you don’t love.

– Ramit Sethi

Total Frugality

Living a life of total frugality, in my humble opinion, can be tiring and stressful especially if you’re constantly inspecting the cost of everything. Don’t get me wrong, I understand that saving for the future is incredibly important and if you find fulfillment in practicing total frugality, hats off to you and continue your journey. But in like all things in life, I believe there has to be balance.

YOLO’ers (You Only Live Once)

The opposite of total frugality are the YOLO’ers (You only live once folks). Life is short, go all out on the now and not worry about the consequences on your spending actions today and deal with it tomorrow. Admittedly there might have been a brief period in my early years where I adopted this thinking. Fortunately for me, I quickly snapped out of this. I understand the mental joy and happiness one has by acquiring materials and experiences. However, similar to the above section on total frugality, there has to be a balance…. literally. The math is simple. Continuously spending more than you earn equates to a miserable life.

This is why I love Sethi’s approach. It responsibly combines the 2 lifestyles into a happy medium. One of my goals in life (albeit the 5th in priority) is to have a “big” vacation every year. So what does this mean to me? It means I budget what a “big vacation” costs (everyone defines this differently) and I focus on saving for this every month. It also means I put on my frugal hat for things that I don’t love. To me, currently that includes not acquiring luxury materials like designer clothes, jewelry, gadgets and cars (this goes against every Asian fabric in me).

Spend Only on What you Have

I do have one caveat for Sethi’s quote for spending extravagantly on the things that you love. One additional mindset that I’ve adopted and file it under the Responsible Spending category, is Only Spending on what you have Saved for. This means for my annual vacation, on the first day of the vacation I already have the entire budgeted spend in my bank account already. I’m not going on a trip in January and spending February – December paying for it. The exception to this rule is your home. I mentioned above that my 5th goal is to have a “big” vacation every year. My 2nd highest goal in life is to “Never be in debt (besides my home mortgage).” More on my personal Goals below. This is why we won’t take our annual trip if we don’t already have it saved for because it would lead to debt which is a higher goal than annual vacations.

Mastering Money Management

Ramit Sethi goes deep into the science of managing your money. His approach is to provide a simplified approach into what can be an overwhelming topic for some.

Creating a Budget

Sethi guides you through the process of creating a budget that aligns with your goals and values. Budgeting can appear tedious or constrictive, he is aware of this, but he flips the script by transforming it into a tool for empowerment and financial freedom.

When creating your budget, Sethi emphasizes the significance of being flexible and realistic. He advises you to adopt a system that allows for both responsible saving and guilt-free spending rather than rigidly adhering to strict spending limits. You can clearly see where your money is going and how it can best serve you if you take a close look at your income and expenses.

The book suggests having these guidelines when allocating your budget:

| 50-60% | Monthly fixed expenses (e.g. rent, utilities, car insurance, debt repayments) |

| 10% | Long term investments (e.g. 401(k), Roth IRA and other investment accounts) |

| 5-10% | Savings for short-term + long-term goals |

| 20-35% | Guilt-free discretionary spending |

Sethi also suggests using tools like Mint and Empower (fmka Personal Capital) to monitor your budget and spend. The key difference is that Sethi doesn’t want you to feel deprived or constrained. He wants you to be financially responsible while living your best life. His strategy is spending money on things that truly make you happy and reducing spending on items that don’t reflect your ideals. You can prioritize your happiness and make sure that your finances are in line with your goals by deliberately spending on the things that are most important to you, whether they are experiences like travel, education, or quality time with loved ones.

You acquire a sense of control and empowerment over your financial life by making a budget that works for you. It turns into a tool that aids in strategic resource allocation, conscious decision-making, and long-term goal achievement. With Sethi’s approach, budgeting becomes less of a burden and more of a freeing habit that puts you on the road to financial success.

Automating your Finances

Sethi advises setting up automated investments, money transfers, and bill payments. By doing so, you create a system that manages your financial responsibilities on your behalf. Imagine never again having to worry about late fees or missing a bill payment deadline! Automating your finances gives you peace of mind and frees up your time so you can concentrate on more crucial areas of your life.

However, it’s not just about making ends meet. The book also underlines how crucial saving automation is. You can easily accumulate savings over time by setting up periodic transfers from your paycheck or checking account to a different savings account or investment account. This guarantees that you constantly save money for unexpected expenses, long-term objectives, and financial security. We all know that I’m a big proponent of automated investments in low cost Index Funds. Read More

Conscious Spending

We eluded to this in the beginning of the blog regarding being in the middle of Total Frugile and a YOLO’er. Sethi essentially is trying to shift you away from mindless consumption (ie a YOLO’er) and instead directing your resources towards the things that truly matter to you.

Conscious spending doesn’t mean being overly frugal or sacrificing all luxuries. It’s about finding the right balance between enjoying the present and securing your future. Sethi’s approach gives you permission to indulge in the things that truly bring you joy, whether it’s travel, hobbies, education, or supporting causes you care about. By cutting back on unnecessary expenses and redirecting those resources towards your priorities, you create a sense of financial freedom and fulfillment. This approach allows you to extract maximum value from your money while minimizing wasteful spending on things that don’t truly enrich your life.

The way I absorb this is by Goal Setting. My suggestion is to sit down with your partner and come to agreement on life goals. This list can be as big or small and be as detailed or broad as you wish. Once the list has been agreed upon by you and your partner, keep it somewhere where you can easily revisit. As an example, here is my prioritized list of goals:

- Retire without the need to ask our kids for help

- Never be in debt (besides mortgage)

- Helping kids with school partially

- Present for wife- 20 year anniversary

- Have a “big” vacations every year

Prioritization is key for me when looking at my goals. As you can see, I have a present for my wife and vacations as goals. However I also have a higher prioritized goal of never being in debt. That means I’m not going to slap an expensive gift on my credit card and hope to pay it off in the future.

I once had a conversation with a 1st generation Asian American friend of mine. He told me that he doesn’t want to be like his parents. Work, work and work without ever going on vacation or enjoying life. After reading this book, I had a different take on my friend’s parents. I believe their goals were to bring their family over to the US for a better life. More importantly they wanted a better life for their 3 sons and hopefully provide a better future for them. Fast forward 30 or so years, my friend and his brothers have all grown. Able to grow families and careers. As for the parents, they were able to retire and not forced to work in order to live and now have tons of grandkids they enjoy visiting and watching grow. I believe they more than achieved their goals and is truly living out their version of a rich life.

Generate Passive Income

Name me a person who doesn’t want to build wealth while you’re sleeping. Sethi examines a number of strategies for making passive income, including index funds, real estate investments, high-yield savings accounts, and more. He demystifies these financial possibilities so that folks from all walks of life can access and comprehend them. You can take advantage of the power of compounding and watch your wealth increase over time by making wise and smart investments with your money. More about how I feel about compound interests here.

The appeal of passive income is that it generates many streams of income, allowing you to diversify your financial holdings and lower your risk exposure. This indicates that you aren’t totally dependent on a single source of revenue, like your employment. Instead, you’re laying the groundwork for long-term stability and expansion. By adhering to Sethi’s advice, you can unlock the possibility of financial wealth while you’re sleeping and learn how to make your money work for you.

Take on Financial Advisors

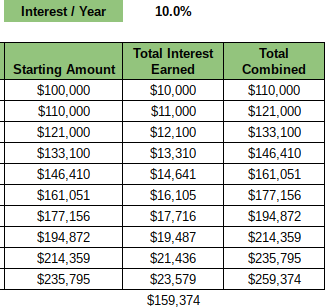

While the “How to be Rich” book goes in depth into a lot of areas regarding managing finances, one stance that he has that stuck with me is his stance regarding Financial Advisors that charge you based on total portfolio. It’s a common practice for Financial Advisors to charge you around 1% of the portfolio they are asked to manage. While 1% sounds minimal and doesn’t feel impactful but can ultimately mean tens of thousands of dollars. Let me prove it to you.

Let’s say you have a portfolio of $100,000 and you hired a Financial Advisor that charges you 1% annually. Using an annual growth of the S&P500 of 10%, we can see that without an Advisor

Let’s say you have a portfolio of $100,000 and you hired a Financial Advisor that charges you 1% annually. Using an annual growth of the S&P500 of 10%, we can see that without an Advisor after 10 years, you’ll have a portfolio of nearly $260,000.

However with an Advisor that charges 1% annually, after 10 years your portfolio is $235,000. That’s a $25,000 difference! More importantly, that’s also $25k that you don’t have to continue compounding and growth in future years.

As you can see, the affects of a “messily 1%” is truly meaningful. Sethi isn’t totally against hiring a Financial Advisor, however he only suggests hiring them for hundreds of dollars an hour. Even a couple of hours of $500/hr is certainly going to be cheaper in the long run when compared to a “messily 1%.”

Takeaways

There are other aspects of finance that Sethi gets into that I didn’t cover. However, the book “I will Teach You to be Rich” by Ramit Sethi is a priceless tool for people looking to become financially independent and accumulate wealth. You can put yourself on a path to financial success by changing your mindset, becoming an expert at money management, navigating career growth, and getting past financial obstacles.

The most important takeaways from Sethi’s book give readers the power to take charge of your financial future, match your values with your financial goals, and make wise choices that result in long-term wealth accumulation. You can transform your relationship with money, secure your financial future, and ultimately lead an abundant and fulfilling life by implementing the strategies and principles outlined in the book.

What does your version of a rich life look like?

We would like to emphasize that we are not financial advisors. The information provided on this website and in our YouTube videos is strictly for educational purposes and represents our personal opinions. To ensure the most appropriate financial decision for your specific needs, it is essential to conduct thorough research and, if necessary, consult with a licensed financial advisor. It is important to acknowledge that all investments involve inherent risks, and there is no guarantee of success in generating, saving, or investing money. Additionally, there is a possibility of experiencing losses when investing. It is crucial to exercise prudence, make informed choices, and independently verify information.