We thought it would be neat to grab examples of real life questions asked on Reddit and see how we can break it down the Hut Yee Way. There will be some information that will be redacted for privacy reasons.

Story:

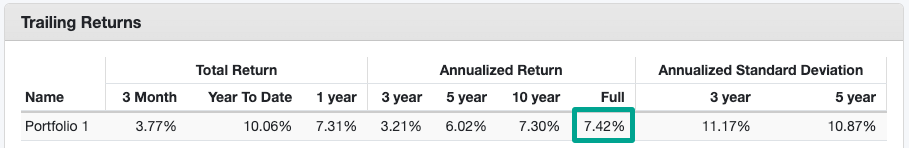

My dad invested with **redacted** for 15 years and his rate of return is 4.5% (annually) and was told his portfolio was doing “great.”

A few years ago, I asked my dad how much his retirement nest egg was. He said around $600K. Tonight I asked him the same question. He said around $600K. Confused, I asked to see my dad’s statements. I just found out that my dad’s return over the past 15 years is around 4.5% (annually).

He’s mostly invested in various bonds with high expense ratios (like BBCPX?). He’s also being charged 1.4% “Program Fees and Commission Costs.”

My dad said he meets with the broker once a year and is always told his portfolio is doing great. The reports his broker gives him are nothing but random bar charts and graphs and don’t even identify his investments. We had to go to his account online to see what he’s invested in.

My dad is 68 and will retire when he’s 70 so is the broker just being super conservative with my dad’s age? The return rate seems low considering what the past decade has been for returns.

I’m pretty good with investing (just sticking it in S&P index funds) and am thinking about taking over my dad’s portfolio. However I don’t even know what someone at that age should be invested in.

Last question…my dad has $620K in retirement investments and plans to receive $3K/month in social security. Will he be ok?

What Would You Do?

Curious about what you would do in that situation based on your experiences or, hopefully, based on what you’ve learned from this site? Have a think and select “show more” below to see what we would suggest.

We would like to emphasize that we are not financial advisors. The information provided on this website and in our YouTube videos is strictly for educational purposes and represents our personal opinions. To ensure the most appropriate financial decision for your specific needs, it is essential to conduct thorough research and, if necessary, consult with a licensed financial advisor. It is important to acknowledge that all investments involve inherent risks, and there is no guarantee of success in generating, saving, or investing money. Additionally, there is a possibility of experiencing losses when investing. Exercising prudence, making informed choices, and independently verifying information is crucial.