This is an age-old question. How much money should be saved by what age? For some, you might be asking, “What am I saving for?” Unfortunately, that question answers why half of Americans have no retirement savings. That’s a staggering statistic and not what we at this site promote. One of our highest prioritized goals is to retire without asking our kids for financial help. Everyone has a different standard of living as well as retirement expectations. Therefore we’re just providing a benchmark for you to compare based on your circumstances.

In this post, we’ll be throwing out a lot of numbers. We’ll run through earnings by age, savings by age, and, more importantly, what you COULD save by following the Hut Yee Way.

Living Below Your Means

Before diving into the meat of the post, it’s essential to set the stage on the philosophical behavior of saving money. Many might say that they would save more if they made more. While this is true for some, it isn’t valid for all. Your annual salary alone can’t dictate what you save. It’s what you earn and what you SPEND, equating to your savings. It is a simple math of credits and debits.

A recent study showed 49% of Americans earning $100+k living paycheck to paycheck. It’s human nature to spend more as they make more. Who doesn’t want to live a lavishing lifestyle, vacationing whenever buying things they like and living in beautiful homes? But once again, it is a simple math of credits and debits. A debit equal to or greater than your credit will never equal savings.

Studies have shown time after time that living paycheck to paycheck has very little to do with income levels but rather with spending levels. Anyone who spends everything they earn will find themselves in this position

Bobbi Rebell, founder of Financial Wellness Strategies and author of Launching Financial Grownups.

Living below your means for us does not mean you turn into Ebenezer Scrooge. We’ve written about Ramit Sethi’s book “I will Teach You to be Rich” and we agree with his take on money priorities.

Frugality isn’t about cutting your spending on everything. That approach wouldn’t last two days. Frugality, quite simply, is about choosing the things you love enough to spend extravagantly on— and then cutting costs mercilessly on the things you don’t love.

– Ramit Sethi

50/30/20 Budget Rule

We’ll most likely be writing a post on budgeting in the future, but we support a popular 50/30/20 (after-tax) budget rule.

- 50% Needs: Needs are bills you must pay for survival. IE mortgage, groceries, utilities, etc.

- 30% Wants: Money spent on non-essential items. IE dining out, events, leisure, etc.

- 20% Savings: Savings and Investments. (This is after-tax which aligns closely with the 15% savings (pre-tax) below

Savings By Age

This study uses the median earnings by age from the US Bureau of Labor Statistics.

We'll also use the 2019 Survey of Consumer Finances study to view retirement savings by age group. Please note that we'll use the average/mean savings instead of the median. We realize that the median is likely a better metric since it normalizes the extreme (very high and very low) numbers. However, we believe the median numbers are just too low due to the large population that isn't saving. Even with that, we think that even using the suboptimal average savings, there is room for improvement.

20 to 34

| Median Annual Wage | $52,936 |

| Average American Savings | $30,170 |

| Hut Yee Savings Benchmark | $48,642 |

| Fidelity Suggested Savings | 1-2x Salary |

This is a crucial age for your future financial state. This is where you build the foundation of money management that you can hopefully replicate throughout your life. With the burden of student loans in the US and you stepping into your career, we believe having a net worth of $0 in your late 20s is excellent. Even better if you can start having actual savings in your late 20s; as you see below, we're not expecting you to ramp up savings until you turn 30.

Hut Yee Savings of $48,642:

- We're accounting for your 20s to be used for debt payments

- Start saving 15% at the age of 30. $662/mo (52,936 x 15% / 12)

- Invest for 5 years at an 8% average return

35 to 44

| Median Annual Wage | $63,596 |

| Average American Savings | $131,950 |

| Hut Yee Savings Benchmark | $253,410 |

| Fidelity Suggested Savings | 3-4x Salary |

By this age, hopefully, saving 15% has become 2nd nature to you. You'll likely be making more, so the 15% of savings will be higher.

Hut Yee Savings of $253,410:

- Saving 15% (pre-tax). $795/mo (63,596 x 15% / 12)

- Invest for 10 years at an 8% average return

45 to 54

| Median Annual Wage | $64,428 |

| Average American Savings | $254,720 |

| Hut Yee Savings Benchmark | $648,602 |

| Fidelity Suggested Savings | 6-7x Salary |

If you have followed the Hut Yee process and mirror the median annual salary, this is the period where you'll likely be crossing the exciting $500k savings barrier. Statistically, your yearly earnings are also the highest at this age. You might start feeling that retirement isn't that far away. Due to this, it's critical to begin rebalancing your investments (hence our lowering of average return below).

Hut Yee Savings of $648,602:

- Saving 15% (pre-tax). $805/mo (64,428 x 15% / 12)

- Invest for 10 years at a 7% average return. We're lowering the rate for less risk. Perhaps more bonds.

55 to 64

| Median Annual Wage | $63,336 |

| Average American Savings | $408,420 |

| Hut Yee Savings Benchmark | $1,309,857 |

| Fidelity Suggested Savings | 8-10x Salary |

This is the final stretch of the accumulation phase, where you perform monthly savings. We're lowering the average return once again. For the most part, if you have followed the plan, you are most likely over the $1M mark.

Hut Yee Savings of $1,309,857:

- Saving 15% (pre-tax). $792/mo (63,336 x 15% / 12)

- Invest for 10 years at a 6% average return. We're lowering the rate again for less risk. Perhaps even more bonds.

65 to 74

| Median Annual Wage | $54,184 |

| Average American Savings | $426,070 |

| Hut Yee Savings Benchmark | $2,157,347 |

| Fidelity Suggested Savings | 10x Salary |

You are officially out of the Accumulation phase and now in the Preservation Phase—no more monthly savings (or perhaps just a few more years). You can start withdrawing a portion from your account annually (IE 4% annually). However, if you're fortunate enough and don't need to perform withdrawals, at 74, your savings will grow to over $2M, even with 5% annual interest.

Hut Yee Savings of $2,157,347 (without withdrawals):

- No More Savings

- Invest for 10 years at a 5% average return. We're lowering the rate again for less risk. Perhaps even more bonds.

Takeaways

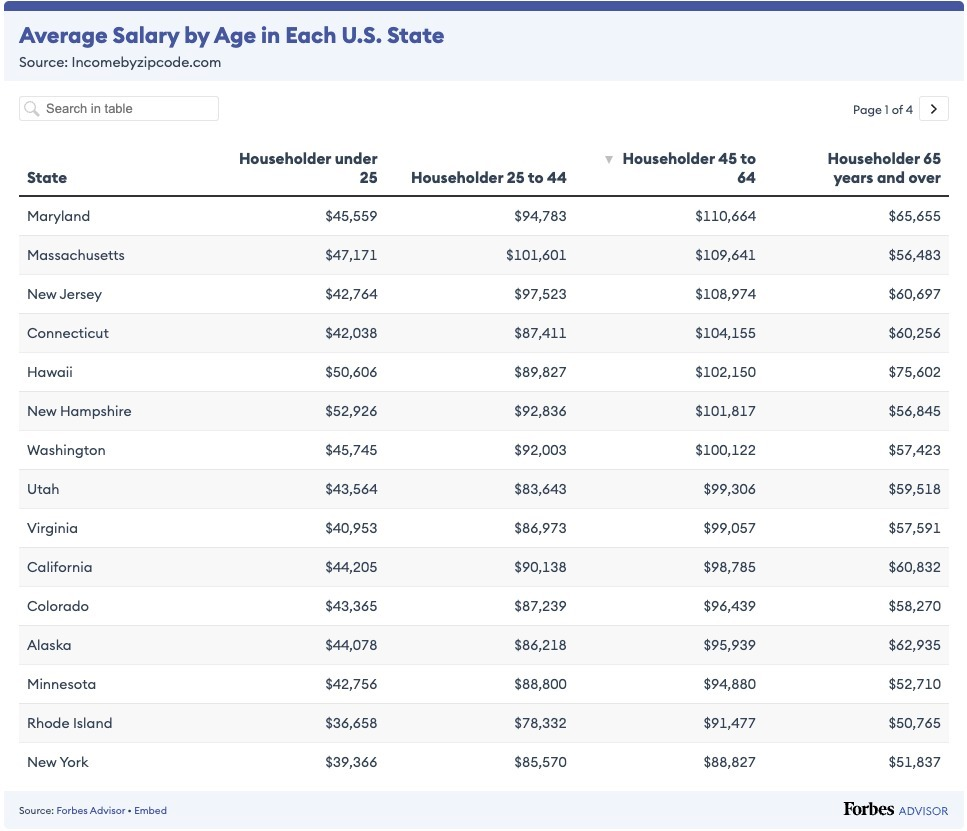

Hopefully, this post and all the numbers don't discourage you from going through the process. We understand that everyone has different circumstances and that perhaps having savings of over $1M might seem very lofty and unachievable. The bright side to all these numbers is that they derive from the entire country's median annual salary. Based on the traffic visited on this site, 90+% of the visitors are based in either the East or West Coast of the US. And luckily for you, the median annual salary is a lot higher.

And with a higher salary enables you to save more per month or save less than 15% of your income but still meet the monthly savings outlined above.

The other thing we hopefully aren't portraying is that it's too late to start. We've written about this in the past and fully believe that building muscle memory and practicing the art of saving outlined in this post at any age should bring a brighter future to your horizon.

We would like to emphasize that we are not financial advisors. The information provided on this website and in our YouTube videos is strictly for educational purposes and represents our personal opinions. To ensure the most appropriate financial decision for your specific needs, it is essential to conduct thorough research and, if necessary, consult with a licensed financial advisor. It is important to acknowledge that all investments involve inherent risks, and there is no guarantee of success in generating, saving, or investing money. Additionally, there is a possibility of experiencing losses when investing. It is crucial to exercise prudence, make informed choices, and independently verify information.