The saying “Nothing is certain in life besides Death and Taxes” is so true. The difference between the two is that Taxes are scheduled, but the time of Death is unknown. We believe that not planning for your death is really doing a disservice to your loved ones. Especially if you’re married with kids. Forrest Gump’s famous saying “Life is like a box of chocolates, you never know what you’re gonna get.” When you’re young, you think of yourselves as invincible and tend to punt that down the road. The reality is that nobody is invincible.

Below are some ways that everyone should exercise to properly prepare your loved ones in case someone does happen to you.

Getting on the Same Page with your Partner

For those who have life partners, being on the same page and communicating your hopes and wishes is vital. When you and your partner share similar beliefs and expectations about death, it creates a sense of understanding. You both know what to expect, and this shared understanding can help alleviate some of the anxiety and fear associated with death.

Part of being on the same page regarding death is discussing and planning for end-of-life scenarios, including your eventual passing. While it might seem morbid, it’s a practical and caring step. Knowing that your partner will be taken care of and have a clear plan for coping after your death can bring immense peace of mind.

Open and honest communication is the key to being on the same page with your partner. Start by discussing your beliefs, values, and fears surrounding death. This may lead to difficult conversations, but fostering mutual understanding is essential.

Wills and Estate Planning

We’ve all heard of Wills where, upon death, the assets get distributed. Estate planning is even more vital for couples who share their lives, assets, and responsibilities. When you and your partner are on the same page about how you want to distribute your assets, care for any dependents, and designate beneficiaries, you can rest assured that your wishes will be upheld. Without this agreement, legal battles and disputes can arise.

The main benefit of estate planning is that it can be incredibly detailed, unlike a Will. An example estate plan can be:

- Upon the death of you and your partner, your assets (house, accounts, jewelry, etc) are equally divided among your two children.

- However, instead of providing all of your money to them at once. You can stipulate that a portion is set for payment to college.

- If the child is from 18-21, only provide them a certain amount per year

- Once the child is 22+, they can control their entire portion of the death benefits

- If the child is under 18, the legal guardian will be your sister-in-law, and the sister-in-law’s family can live in your house until they are 21. While setting a portion of the benefits for monthly household expenses

This is just an example of how detailed estate plans can be, and we believe it is essential, especially if children and assets are involved.

Life Insurance

Similar to estate planning, life insurance is even more critical if there are young children you care for. The general rule for insurance coverage is 10x your annual salary. That means if you make $75,000 a year, the policy should roughly be $750,000. The hope is to have enough to replace your income, pay off debts, cover future expenses (e.g., education, mortgage), and provide for your family’s financial well-being in your absence.

That being said, there are different forms of life insurance. The two most popular types of life insurance are Term and Permanent insurance.

Term Insurance – is somewhat similar to car insurance. Term life insurance is generally more affordable and provides coverage for a specified term (e.g., 10, 20, or 30 years).

Permanent insurance – such as whole life or universal life, offers coverage for your entire life and often includes a cash value component. Because the length of the insurance is unknown, the type of insurance requires a much higher payment when compared to Term Insurance.

As for what we prefer between the two, we lean towards going with Term Insurance. It depends on your hopes. If the purpose of the insurance is to provide an emergency fund when your family is young and there are many years left on the mortgage, Term Insurance is more suitable. If your hopes are to provide some inheritance to your children (even if they might be as old as 50+), then Permanent Insurance should be your choice.

Just remember that life insurance is a significant financial decision, so take the time to research, understand your options, and choose a policy that aligns with your financial goals and family’s needs.

Information Gathering

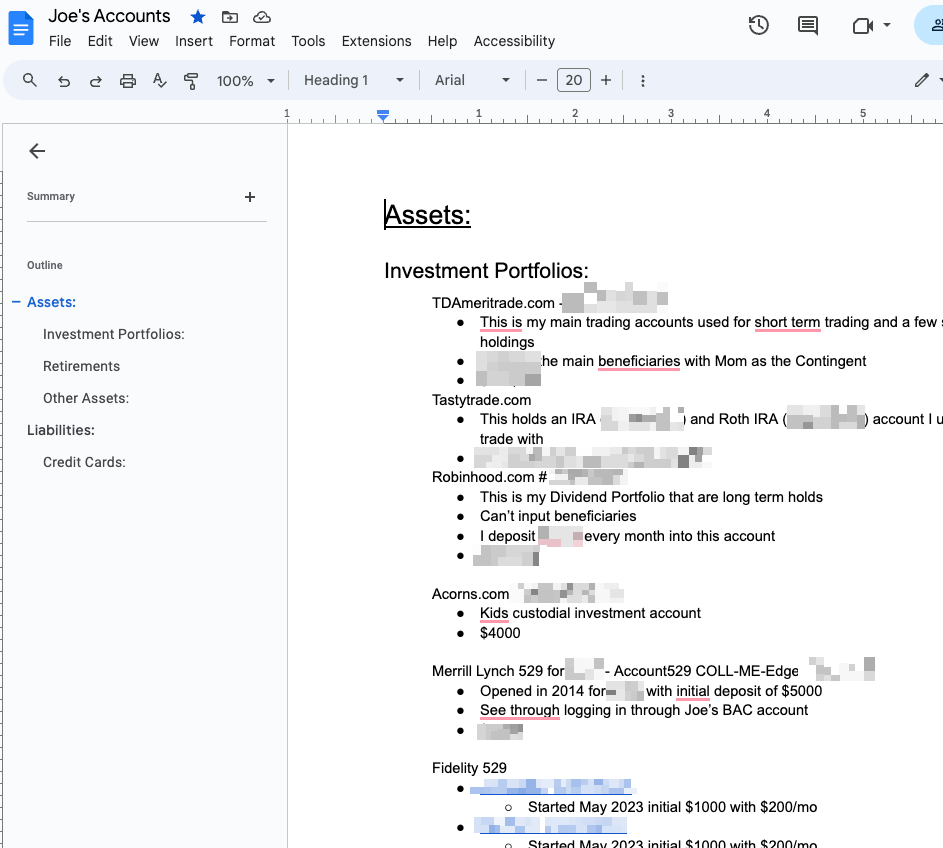

This is probably the easiest and least time-consuming thing you can do to prepare. It is simply just documenting all of your accounts with details. If you have a Gmail account, create a Google Doc and write everything down.

This is a screenshot of my personal document:

- Logins and Accounts to any Investment Accounts

- 401k, IRA, Annuities, etc

- Cash Brokerage Accounts

- Banks

- Logins and Accounts to any Expense Accounts

- Credit Cards

- Mortgage

- Car Payments

- Home Utilities

- Cell Phone providers

Set a reminder on your calendar to update the sheet once a year. By performing this task, you’ll create valuable information for your loved ones if anything happens to you.

Takeaways:

Death is a topic that many people prefer to avoid discussing. It’s often regarded as uncomfortable or even taboo. However, planning for death is not only a practical necessity but also an act of love and responsibility toward your loved ones. By preparing for the inevitable, you can ensure that your affairs are in order and that your loved ones are supported during what will undoubtedly be a challenging time.

I wrote this blog because I recently learned about a family I knew had lost their wife/mother. The news was unexpected and came as a surprise. I can only imagine how hard it must be for my friend Sam (the husband) and their three daughters.

We’re dedicating this blog to them and sending our love.

We would like to emphasize that we are not financial advisors. The information provided on this website and in our YouTube videos is strictly for educational purposes and represents our personal opinions. To ensure the most appropriate financial decision for your specific needs, it is essential to conduct thorough research and, if necessary, consult with a licensed financial advisor. It is important to acknowledge that all investments involve inherent risks, and there is no guarantee of success in generating, saving, or investing money. Additionally, there is a possibility of experiencing losses when investing. Exercising prudence, making informed choices, and independently verifying information is crucial.