We’ve written about the infamous Dave Ramsey Baby Steps. While there is absolutely nothing wrong with following those steps, we have a slightly different take surrounding some of the details.

What the heck is a “Hut Yee?”

Prior to detailing our steps, perhaps we should address the elephant in the room. What the heck is a “Hut Yee?”

Admittedly it all started off as a joke. “Hut Yee” is the phonetic translation or pinyin to the word beggar in Cantonese, 乞兒. Throughout China and a number of East Asia countries, there are a number of beggars on the street asking for money. Some have very sad stories, some choose to do this versus finding a job and some even make considerable income doing so.

I’ve also heard of expressions of people referring to their children as beggar kids (乞兒子). Typically they’re not saying that their children are beggars. It’s more used as a humble expression, down playing their financials.

As for the “Dow” in Hut Yee Dow, besides it being a major stock index that most Americans are used to, it is the phonetic translation of bowl in Cantonese. So Hut Yee Dow’s literal translation is the Beggar’s Bowl where people who choose to give money place their money for the beggar.

So yes, there is some humor and irony in our site name. Another reason for the name was that it was an available .com name!

Assumptions Prior to your Journey of the Hut Yee Way

There are a couple of assumptions prior to you taking on the Hut Yee Way.

- The following steps are to be performed in chronological order and you should only move on to further steps once the prior steps are completed. (With the exception of Step 8… to an extent)

- You know what your monthly expenses are

- You work for a company that offers a 401k retirement as well as your company offering 401k matches

- Investments equate to Stock Market investments. This doesn’t mean you can’t invest in real estate or others. It does become a bit difficult to consistently contribute to non stock market investments however.

- Your mortgage rate (if you have one) has a rate that’s lower than roughly 5%. This certainly should be the case if you purchased a house between 2000-2020.

Printable PDF version of the Hut Yee Way

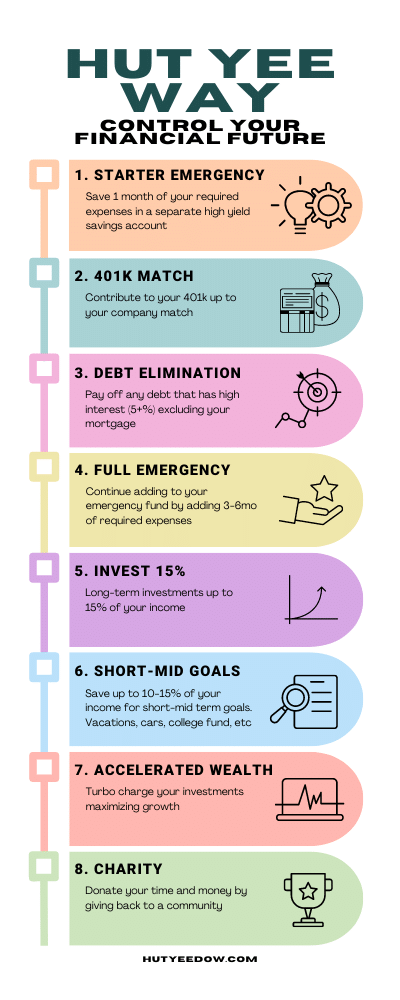

Step 1 – Starter Emergency Fund

Building an emergency fund is crucial for everyone, as unexpected expenses can arise at any time. The starter emergency fund should cover at least one month’s worth of required expenses. Life often presents unexpected twists and turns, such as car problems, health issues, or appliance breakdowns, which tend to occur at the most inconvenient times. By having a reserve of one month of expenses, you provide yourself with a financial safety net to rely on during such challenging situations.

Open a separate Savings account (ideally a high yield savings account) and have your primary bank automatically transfer funds to your emergency account on a monthly basis until that amount is satisfied.

The hope is that you ideally never need to touch this money and also that the high yield interest rate should help you cover inflation on an annual basis.

Step 2 – Contribute to your 401k up to your Company match

We have 401k contributions up to your company match ranked significantly higher than Ramsey’s Baby Steps. This may vary depending on your company’s policy, but let’s say your employer matches your contributions dollar for dollar up to 5% of your salary. It’s highly recommended to take full advantage of this benefit because it’s essentially free money. You’re receiving a 100% return on your investment from day one, and you get to enjoy the growth it generates.

Our thinking is that even if you have a credit card balance owing 20+%, the benefit of your company matching 50-100% is a much better use of your money. The story significantly changes if your company doesn’t perform a match. In that case, you should skip step 2.

Step 3 – Payoff all of your Debt (excluding mortgage)

Hopefully you don’t have any debt besides a mortgage. We focus on any debt that has interest rates over 5-7%. The reasoning behind this is that the market on average returns 8-10% and if your debt has a rate of 7%, there’s not enough meat for the risk.

If you by chance carry a credit card balance, that is the area you need to pay attention to first because they likely have an interest rate over 20%. Our recommendation is to tighten up your belt and really scrutinize your spending to essentials. Set up automated payments well above paying the minimum balance and concentrate on paying off your debt as fast as possible.

Step 4 – Save 6 months of Expenses for your Emergency Fund

You are now adding onto Step 1 and increasing it to 6 months of expenses.

If you’ve already set up a separate High Yield Savings account with a reputable bank for Step 1, you can combine your savings and gradually increase your reserves. Remember to maintain at least the established amount in your emergency fund at all times. If you ever need to dip into it for any reason, make it your top priority to replenish the fund as soon as possible.

By setting aside 6 months’ worth of expenses, you’ll likely be well-prepared to handle any unexpected events that life throws your way. More importantly, having this financial safety net will provide you with a priceless peace of mind. It’s like having insurance for your finances—a valuable asset indeed!

Step 5 – Invest 15% of your Annual Income

The title says it all and is pretty self explanatory. The key is 15% of your pre-tax income and not 15% of your take home pay. And if your company performs a 401k match, we don’t include that in the 15% as well. We categorize company matches as frosting on the cake or perhaps the market generating great returns.

Investment Destinations – Priority Order for Retirement Accounts

- 401k up to the company match: This may vary depending on your company’s policy, but let’s say your employer matches your contributions dollar for dollar up to 5% of your salary. It’s highly recommended to take full advantage of this benefit because it’s essentially free money. You’re receiving a 100% return on your investment from day one, and you get to enjoy the growth it generates. It’s a no-brainer in my opinion. In fact, I wouldn’t argue if you told me you did this even before paying off your debt.

- Roth IRA: Roth IRAs work by investing money that has already been taxed (i.e., your take-home pay) into the IRA. The best part is that withdrawals after the age of 59.5 are tax-free. However, there are certain limits to consider. For example, there is an annual maximum contribution (in 2023, it’s $6,500 or $7,500 if you’re 50 or older) and an income requirement that must be met. In 2023, if you’re single and your income exceeds $153,000, or if you’re married filing jointly and your income exceeds $228,000, you are not eligible for a Roth IRA.

- Back to 401k: If you’ve taken advantage of the 401k match and contributed to a Roth IRA but still haven’t reached the 15% mark, it’s advisable to contribute more to your 401k, even without additional matching from your employer. Keep in mind that there are annual contribution limits for 401k accounts (in 2023, it’s $22,500). What has also become popular are also whats known as Roth 401k that you may want to look into.

- Health Savings Account (HSA): One can argue that contributing to your HSA would be more of a priority. There’s no disagreement from us but there are factors that come into play. Does your employer offer HSA? Does it makes sense for you (or family) from a health perspective to subscribe to a high deductible health insurance?

- Brokerage account: If you’ve followed the previous steps and still haven’t reached the desired 15% contribution or wish to invest more, congratulations! You likely have a higher income that disqualifies you from a Roth IRA, and the $22k limit in your 401k falls short of the 15% target. In such scenarios, I recommend opening a brokerage account that allows fractional share purchases and facilitates automatic monthly investments. Choose low-cost index funds or target-date funds and set up automatic withdrawals from your bank account for monthly purchases. This account should be straightforward and low maintenance, much like your 401k. Keep in mind that this account is subject to taxes on sold profits. However, the intention is to hold these funds for many years to come. To learn about how to setup such accounts and use the referral links to help support the site, Click Here.

Step 6 – Save for Short-Mid Term Goals

We suggest saving around 10-15% of your income on short and medium term goals. These goals can be saving for gifts for others, gifts for yourself, vacations, a car and even a college fund for your children like Fidelity’s 529 plan.

You’ll notice that we emphasize investing 15% for your retirement over these goals in step 6 and that’s intentional. Remember the last time you took a flight and the attendant explained emergency procedures? They say that in an event of an emergency, you first strap on the oxygen mask before helping others. Well, we also support that theory when describing financial objectives. First, plan for your retirement. If things are on track, then plan for gifts, vacations, cars and even your children college funds.

Step 7 – Accelerated Wealth

This part is pretty simple to understand. If you have made it through the 6 steps above, you’re in pretty good financial shape. But it doesn’t hurt to do more. Instead of the 15% of your income for investing, invest even more! If you can invest 20% to even 50% of your income, you deserve a golf clap.

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

Albert Einstein

We’ve extensively written about the power of compound interest (also known as the 8th wonder of the world) and have also provided a free monthly investment calculator to estimate what certain amounts invested monthly provide during retirement.

Where you prioritize your investment allocation follows the same as above in Step 5.

Step 8 – Charity and Donations

This is the only step in the Hut Yee Way that doesn’t require prior steps to be completed to an extent. Performing charity work and donations don’t always mean donating money. Giving could mean regularly giving blood, helping out a non-profit, coaching kids’ sports, walking for a cause, writing a blog hoping that you can affect one person, etc. If we’re strictly talking about these examples, by all means, do as much of it as you want.

If we’re talking about meaningful/large regular money donations, we highly suggest saving till after step 7.

Takeaways

In conclusion, the Hut Yee Way is not just about numbers and financial jargon; it’s about empowering yourself to take control of your money and your future. Think of it as your personal financial GPS, guiding you step by step on a journey towards a better financial life.

Imagine having that sense of security knowing you have an emergency fund to fall back on when life throws its curveballs. Picture the excitement of watching your retirement savings grow, taking full advantage of your employer’s match to supercharge your nest egg. And all the while, you’re still able to enjoy the little things in life, like that dream vacation or surprising your loved ones with thoughtful gifts.

But it’s not just about building your wealth; it’s also about making a positive impact in the world. The Hut Yee Way encourages you to give back, whether through charitable donations or simply lending a helping hand to those in need. Because when you have your financial house in order, you can be a force for good and make a difference in your community.

So, take that first step towards financial freedom and embrace the Hut Yee Way. It may have started as a joke, but its wisdom and practicality are no laughing matter. By following these principles, you’re not just building a better financial future; you’re building a better life for yourself and those around you. Let’s embark on this journey together, supporting and inspiring each other along the way. Here’s to a brighter, more prosperous, and compassionate future – the Hut Yee Way!

We would like to emphasize that we are not financial advisors. The information provided on this website and in our YouTube videos is strictly for educational purposes and represents our personal opinions. To ensure the most appropriate financial decision for your specific needs, it is essential to conduct thorough research and, if necessary, consult with a licensed financial advisor. It is important to acknowledge that all investments involve inherent risks, and there is no guarantee of success in generating, saving, or investing money. Additionally, there is a possibility of experiencing losses when investing. It is crucial to exercise prudence, make informed choices, and independently verify information.