The top 1% have always had access to a variety of wealth preservation and wealth expansion tactics in the world of financial planning and wealth building. Health Savings Accounts (HSAs) are a tactic that has become very popular recently. HSAs were first created to assist people in managing their medical expenses. However, they have newly developed into solid instruments for the wealthy to cover healthcare bills and carefully invest in and increase their wealth.

Understanding Health Savings Accounts (HSAs)

HSAs were designed to alleviate the burden of healthcare expenses for individuals with high-deductible health insurance plans by contributing a certain amount of money into the account and only withdrawing from the account on qualified medical expenses. The unique benefit of HSAs are their remarkable tax benefits.

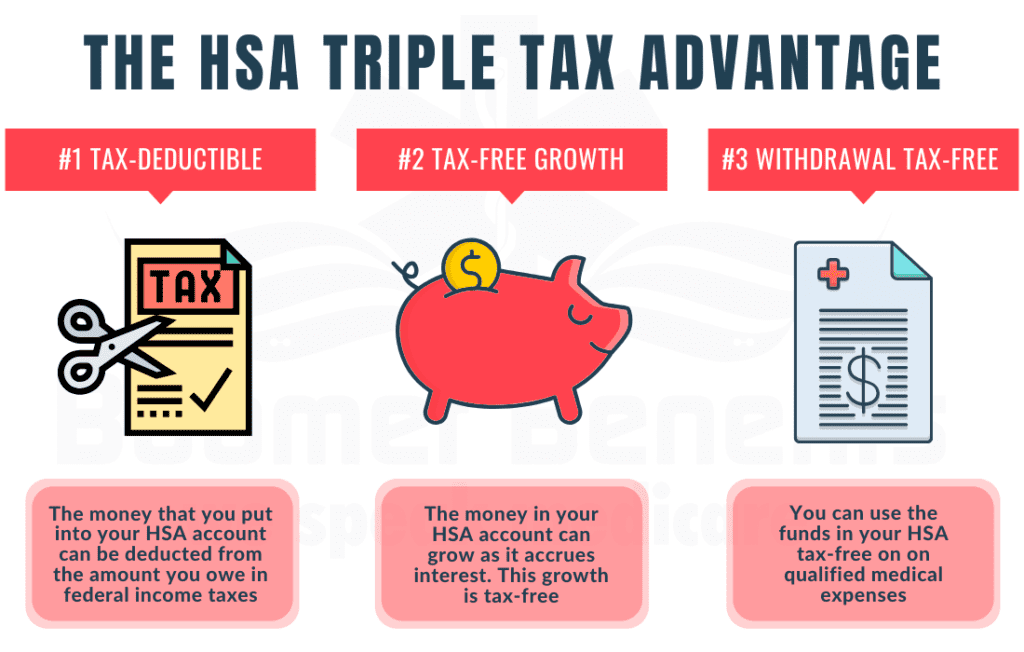

HSAs offer a “triple tax advantage” which no other investment vehicle currently offers.

- Money contributed is tax deductible

- Account growth is tax-free

- Withdrawals (for qualified medical expenses) are tax free

The likelihood of everyone incurring some form of medical expense is high especially during retirement, so why not take advantage of the tax incentives?

Contribution Limits

Similar to most tax incentivized investments (Roth, 401k, etc), the IRS has restrictions in place. At the time of this writing in 2023, the contribution limits for Self only is $3,850 and for Family is $7,750. The good news is that the 2024 limits have increased.

HSA Contribution Limits

| Self Only | Family | 55+ Catchup | |

| 2023 Limits | $3,850 | $7,750 | +$1,000 |

| 2024 Limits | $4,150 | $8,300 | +$1,000 |

Employer Contributions

Similar to 401k matches, employers optionally can contribute to your HSA. Payout types from employers ranges from a percentage of pay to fixed amounts per employee. My company for example pays a flat rate of $1000/yr for anyone choosing the high-deductible health insurance.

Unlike 401k contributions, the only caveat behind employer contributions is that it must be accounted for in the annual contribution limits. For example, the 2023 Family contribution limit is $7,750. Since my employer contributes $1,000, I can only contribute $6,750 ($7,750 – $1,000).

Investment Opportunities

We all know we wouldn’t be writing a blog on a topic if there wasn’t an investment aspect to it. This we believe is the power of HSAs. Similar to a 401k or an IRA account, now that you have contributed money, you can now invest it. Depending on your plan, you’ll most likely be able to select funds and build an investment strategy.

As far as investment priorities, we’ve written this in the past in the Hut Yee Way. We believe that it’s after 401k matches and before opening up a taxable brokerage.

Strategic Payment and Long-Term Planning

One effective strategy in utilizing your HSA is the pay out of pocket now and reimburse way later (like after retirement later). This strategy assumes:

- You have enough money to cover your medical bill (We suggest tapping into your emergency fund)

- You’re invest the funds in your HSA and that the market will have a positive rate of return

- You are organized enough to keep receipts for many many years

Let’s use an example. Say you’re 35yrs old and you received a medical bill for $1,000. Instead of withdrawing the amount from your HSA to pay the bill, you decide to pay the bill out of pocket and keep the receipt in a safe location. Because there is no expiration date on submitting reimbursements with qualified medical receipts, you decided you rather have the $1,000 in your HSA grow and compound for 30 years. With a conservative return rate of 6%, that $1,000 amount that you did not withdraw at the age of 35 now turns into over $6,000 at the age of 65. Now at 65, you then pull out your receipt and submit reimbursements.

No RMDs (required minimum distributions)

Another wild benefit of HSAs is that there are no RMDs. With Traditional 401k or IRAs, there’s a notion of a RMD where pre-taxed contributions are required to be withdrawn and taxed at a set age (currently 73). With HSAs, even though your contributions are pre-taxed, it is not subject to RMDs. This allows you to bequeath your HSAs to heirs, who can continue benefiting from tax-free growth and withdrawals for qualified medical expenses, thereby creating a lasting financial legacy.

Once again, if receipts are stored safely, there are examples of heirs submitting reimbursements after the death of their parent allowing the account to compound significantly.

Takeaways

In today’s world of financial planning and wealth-building, the top 1% are well-versed in a range of strategies to safeguard and grow their fortunes. Among these tactics, Health Savings Accounts (HSAs) have emerged as a recent favorite. Initially conceived to help individuals manage medical costs, HSAs have evolved into powerful instruments for the affluent to not only cover healthcare expenses but also strategically invest and amplify their wealth. What sets HSAs apart is their triple tax advantage—contributions are tax-deductible, account growth is tax-free, and withdrawals for qualified medical expenses remain tax-free. With high contribution limits, the potential for employer contributions, diverse investment opportunities, and a strategic payment approach, HSAs have become a vital addition to the financial toolkit of the wealthy. By employing these strategies and capitalizing on the unique benefits HSAs offer, the top 1% are effectively securing their financial futures while navigating the ever-present reality of healthcare costs.

We would like to emphasize that we are not financial advisors. The information provided on this website and in our YouTube videos is strictly for educational purposes and represents our personal opinions. To ensure the most appropriate financial decision for your specific needs, it is essential to conduct thorough research and, if necessary, consult with a licensed financial advisor. It is important to acknowledge that all investments involve inherent risks, and there is no guarantee of success in generating, saving, or investing money. Additionally, there is a possibility of experiencing losses when investing. It is crucial to exercise prudence, make informed choices, and independently verify information.