If only I had a DeLorean (I’m showing my age), I would tell myself to purchase Low-Cost Index Funds consistently throughout my life. I believe it’s a game changing strategy that really anyone can adopt.

Discovering the Power of Low-Cost Index Funds

Like many people, I was initially overwhelmed by the vast array of investment options available when I was younger. From individual stocks to actively managed mutual funds, the choices seemed endless, and the pressure to make the right decisions was intense. However, my perspective changed when I discovered the power of low-cost index funds.

Index funds are designed to track a specific market index, such as the S&P 500, the Total Stock Market Index or the Nasdaq 100. Instead of relying on the expertise of fund managers to select individual stocks, index funds aim to replicate the performance of the overall market. This approach appealed to me because it meant I could benefit from the collective growth of hundreds or even thousands of companies without the need for extensive research or stock picking skills.

Moreover, what truly captured my attention was the concept of low-cost investing. Traditional mutual funds often come with high expense ratios and management fees that can significantly eat into investment returns over time. In contrast, index funds operate on a passive management strategy, meaning they require less human intervention and, consequently, have lower expenses. This low-cost structure meant that I could keep more of my hard earned money working for me, rather than lining the pockets of fund managers. It was a game-changer that sparked my interest and led me to delve deeper into the world of automated investing with low-cost index funds.

Embracing Automation for Hassle-Free Investing

The world of investing in the stock market could be daunting to some, especially if you don’t have experience. This is why automated investing with low-cost index funds intrigued me. It’s just like if you’re participating in your company’s 401k. You chose your amount and you selected a fund and the contributions automatically get deducted from your paycheck and purchased the fund.

For me, not only do I contribute to my 401k every paycheck, I also setup automated investing from my brokerage account. Every 6th of every month, my broker withdraws a set amount and helps me purchase SPY (the S&P 500 index ETF). This is also what’s know as Dollar Cost Averaging (DCA). Essentially, no matter the cost of the underlying stock, you’re consistently buying.

Index Funds Returns

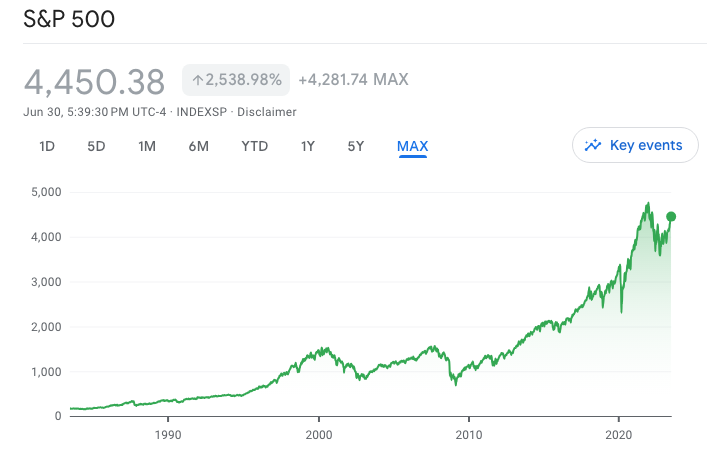

There are quite a few index funds out there but the one that is the most widely regarded and most benchmarked against is the S&P 500 (Standard & Poor’s 500). It represents the 500 of the large publicly traded companies listed on the US stock exchange. Investors and fund managers use the S&P as a benchmark to compare the performance of their portfolios and rarely do they ever beat the market.

So if Fund Managers can’t even beat the market, why not buy the market?

History shows that you are correct. In the history of the S&P, the average annual return is roughly 10%. Of course there have been down years but there also have been years of +30%. There’s no denying how impressive this chart is.

| $1000 Investment in SPY | Worth July 2023 | Annual Return Rate | Total Increase | Total Profit |

| July 2018 | $1,779.24 | 12.19% | 77.92% | $779.24 |

| July 2013 | $3,322.55 | 12.74% | 232.25% | $2,322.55 |

| July 2008 | $4,658.26 | 10.79% | 365.83% | $3,658.26 |

| July 2003 | $6,665.89 | 9.94% | 566.59% | $5,665.89 |

| July 1998 | $4,892.48 | 6.94% | 389.25% | $3,892.48 |

If you were to invest $100 a month from your early 20s until you retire in your late 60s in the S&P 500 making 10%/yr, you’ll in have over $1 million in your portfolio while only using roughly $54,000 of your own capital. Imagine what it would be if you invested more. Check out the calculator to see.

There are ETFs (you can just think of these as stock symbols) that represent Index Funds. Some of the most popular ones:

- SPY or VOO – S&P 500. Large Cap US

- VTI – Total Stock Market Index

- QQQ – Nasdaq top 100 Index (tech-heavy)

- VUG – Large Cap Growth

- VEA – Developed countries outside of US

Keys to setting up your Automated Brokerage

Now that I’ve convinced you this is better than sliced bread, now how do you setup automated investing with low-cost index funds?

- Ideally you need to find a broker that has a feature of automated money withdrawals from your bank account.

- Ideally your broker allows for fractional share buying – Buying fractional shares means you can purchase $100 worth of a stock even if the stock is worth $500. You’ll just get 0.20 shares.

Big brokers like Charles Schwab and Fidelity offers both of these features. I personally use the following brokers (yes I know I have a lot) that have the above features along with my referral link:

- Robinhood – a relatively new broker that changed the industry with its $0 commission structure

- M1 Finance – focused on automation and portfolio customization

- TastyTrade – more geared toward Stock Options

- Acorns – focused on automation as well as a unique approach to rounding up your everyday transactions and investing that amount. Also a place where I have my kid’s custodial account

Takeaways

One crucial lesson I’ve learned is that investing is a marathon, not a sprint. Index funds align perfectly with a long-term investment strategy. Try no to get caught up in short-term market fluctuations or chase the latest investment fads. Instead, focus on consistently contributing to the index fund and let compounding work its magic over time. It’s amazing how those small, regular investments with automated investing with low-cost index funds can grow into something significant over the years.

Is this strategy only meant for younger people and not meant for middle-aged people?

The simple answer to that question is no! (I’ll provide another blog about investing when you’re older in the near future. Stay tuned) Whether you’re a beginner or an experienced investor, I encourage you to explore this approach and see how it can transform your financial journey. Here’s to a future of stress-free investing and long-term prosperity!