It’s unfortunate that a majority of our school systems failed to teach about personal finance. Heck, I learned about woodworking living in a major city in the US but knew nothing about the S&P500. It also didn’t help to be a 2nd generation Asian American where my parents didn’t have the financial know-how and didn’t trust the stock market. So for me, I didn’t truly start exploring until my early 30s and didn’t really start learning financial literacy until my late 30s early 40s.

So, back to the question, “Am I too old to start investing?” I’ll answer the question by saying:

The best time to start investing is as young as possible.

The 2nd best time to start investing is right now!

That’s right, we believe that anyone at any age should dive into the world of stock market investments.

The Timeless Power of Investing

Not only the young or those with significant financial resources can invest. Instead, it is a flexible tool that anyone, regardless of age or experience level, can use. The strength of investing is found in it’s ability to build wealth over time by leveraging the compounding of returns.

We’ve written extensively regarding the power of compound interests. Investing is a marathon, not a sprint. It’s about planting seeds today that will grow into a bountiful harvest in the future. Even if you’re starting later in life, you can still benefit from the long-term growth potential of investments.

“I’m already in my mid 50s. That only leaves me about 10 years to invest.”

What some people fail to comprehend is that even if you plan on retiring at 65, it doesn’t mean you immediately close out your investment account. Even if you no longer plan on contributing new money to the account, the account still continues compounding. With the advancements in medicine and technology, life expectancy is increasing year over year. Would it surprise you that you spend 20+ years of retirement?

With the Rule of 72 we learned how long it roughly takes for your account to double. Even if we use a conservative return of 7% annually, your account will double in value in roughly 10 years. So for example, let’s say you retire at 65 with a $100k portfolio and no longer plan on contributing more funds and just left it alone without withdrawing. At 7% return, your portfolio grows to $200k when you’re 75. When you’re 85yrs old, your portfolio is now $400,000. That’s a 4x return even without contributing more funds for 20 years!

Catch Up Contributions for those 50 or Older

For those who are late in the game of investing, fortunately there are opportunities to “catch up” and start investing.

401k

If your employer offers a 401k program, the annual contribution limits increase for those 50 and older. For 2023, individual 401k contributions for those under 50 is $22,500. However if you’re 50 or older, you can contribute $7500 more. Meaning you can contribute $30,000 annually.

IRA (when qualified)

For those that qualify for Traditional/Roth IRAs, there is something similar for those 50 and older. For 2023, the annual contribution limit for those under 50 is $6500. If you’re 50 and older, that limit increases to $7500.

Taxable Brokerage Accounts

If you have exhausted your 401k and IRA, of course there are always regular brokerage accounts following Ramsey’s baby step 4. Technically there are no limits that you contribute to this account. Keep in mind this most likely involves money that is already taxed and profits are most likely taxed when the investment is sold. Please chat with your accountant to learn more.

Calculator: Monthly Investments by Age + Withdrawal

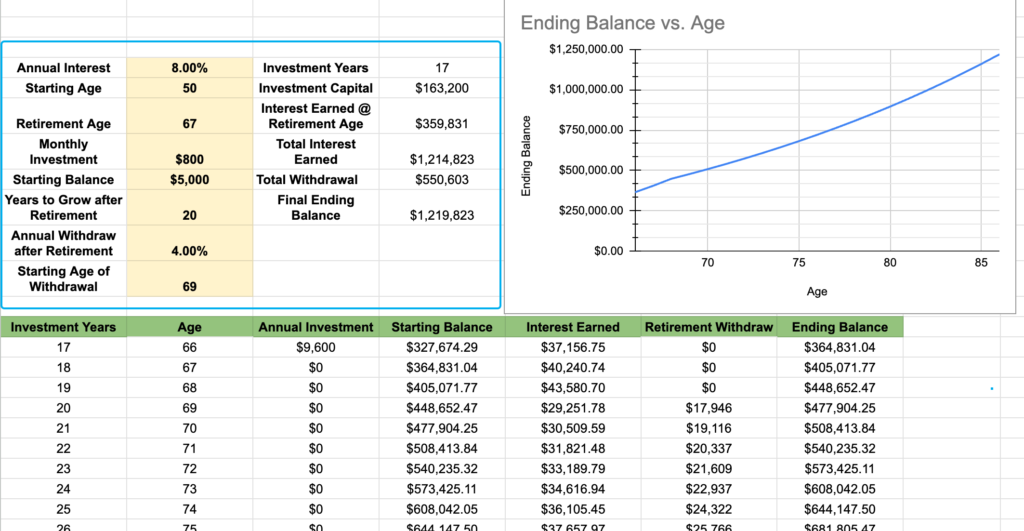

We recently built a simple calculator allowing you to customize your strategy.

You enter:

- Annual Interest Rate: The average S&P500 return is 10% annually. You can be conservative and use 8%

- Starting Age: The age you start investing.

- Retirement Age: The calculator assumes you’ll be investing monthly from the Starting Age (above) till the Retirement Age.

- Monthly Investment Amount: The calculator assumes you’ll be contributing the same amount throughout the strategy.

- Starting Balance: Optional but perhaps you have an IRA from your leftover 401k when you left your last company.

- Years to Grow after Retirement: The calculator will map out the years after retirement.

- Annual Withdraw after Retirement: Optional. A common strategy is to withdraw 4% of your portfolio value annually.

- Starting Age of Withdrawal: Optional. Retiring doesn’t mean you start withdrawing immediately from this account. Perhaps this is a Roth account and you have a taxable 401k or IRA and is required to withdraw (aka RMD – Required Minimum Distribution) so therefore you don’t believe you need to withdraw from this account.

The example above shows a $800 monthly investment starting at the age of 50 and 20 years of retirement resulting in a final balance of over $1.2M even with over $550k of total withdrawals.

Make a copy of this calculator for free and start exploring

Takeaways

The power of investing transcends age barriers. While starting early provides advantages, it doesn’t mean those who begin later in life cannot reap the benefits. By understanding the long-term growth potential and income generation, you can harness the timeless power of investing to achieve your financial goals and secure a brighter future. Remember, it’s never too late to embark on your investment journey and make your money work for you. Start Investing!

Disclaimer:

We would like to emphasize that we are not financial advisors. The information provided on this website and in our YouTube videos is strictly for educational purposes and represents our personal opinions. To ensure the most appropriate financial decision for your specific needs, it is essential to conduct thorough research and, if necessary, consult with a licensed financial advisor. It is important to acknowledge that all investments involve inherent risks, and there is no guarantee of success in generating, saving, or investing money. Additionally, there is a possibility of experiencing losses when investing. It is crucial to exercise prudence, make informed choices, and independently verify information.