By far the most popular tool for building a retirement nest egg is the 401(k). According to a recent study from Vanguard, nearly 85% of the workforce who are offered the 401(k) plan, participate in some form of the plan. That’s great news! I mean, ideally, it should be 100%, but that’s just the Asian parent side of me.

Defined contribution (DC) retirement plans are the centerpiece of the private-sector retirement system in the United States. More than 100 million Americans are covered by DC plan accounts, with $9 trillion in assets.

How America Saves Report 2023 | Vanguard Institutional

However, a disturbing statistic showed that over 60% of Americans don’t understand the 401(k) basics. This blog will go over the basics of 401(k)’s, the types of 401(k)’s, the kind of fund selections, and last but not least, the fees.

What is a 401(k) plan?

Knowing that a 401(k) is not a type of investment is essential. It is simply a type of account used for retirement that has its form of tax benefits. These plans allow you to contribute a portion of your salary and allow you to invest in a variety of investment options chosen by the plan sponsor.

It is important to note that as of 2023, the contribution limits are:

- $22,500 for those under 50

- $30,000 if you are age 50 or older

These contribution limits do not include any Employer sponsored matches.

The ultimate hope for any retirement account is to capitalize on the power of compound interest to save up for your retirement years.

Traditional 401(k) vs Roth 401(k)

There are two main types of 401(k) plans: traditional and Roth. In short, for a traditional 401(k), contributions are made with pre-tax income, which means you’ll pay taxes on withdrawals during retirement. On the other hand, Roth 401(k) plans accept after-tax contributions, allowing for tax-free withdrawals in retirement.

Traditional 401(k)

This is by far the most popular type of 401(k). Not because it is the best. It was simply the only type of 401(k) offered until about 15 years ago, and even today, not all employers have adopted this as an option.

To best explain some requirements and restrictions, we’ll use a made-up character called Melody, who’s 25yrs old. She makes $100,000/annually and has decided to contribute $10,000 to her Traditional 401(k). We’ll assume she has a 30% tax on ordinary income currently and during retirement age.

- Instead of her W2 tax wages at $100,000, she’ll now have it as $90,000 since she contributed $10,000 to her 401(k)

- Her Tax for the current year went down from $30,000 ($100k x 30%) to $27,000 ($90k x 30%)

- She can only withdraw money from her 401(k) without penalty after the age of 59.5

- If she withdraws her money at the age of 65, the $10k she contributed at the age of 25 at 7% return now turns into a cool 15x nearly $150k

- If the Tax remains the same at 30%, the amount taxed for the $150k withdrawal is $45,000

Another important note about Traditional 401(k) and Traditional IRA, is that there is something known as RMD (required minimum distributions). Uncle Sam has waited a long time to tax Melody and now wants some back. Therefore the RMD mandates that you withdraw a portion (this amount changes every year and age however it’s roughly about 4-5%) of your 401(k) every year. At the time of this writing, the RMD age is 73. The RMD table for 2023 can be found here.

Roth 401(k)

Roth 401(k) is still fairly new to the scene. According to a recent study from Vanguard, Roth is only offered by 80% of plans and adopted by 17% of participants in plans offering the feature.

Those who used this feature tended to be younger or higher-income participants.

How America Saves Report 2023 | Vanguard Institutional

Using the same example above with a made-up character called Melody, who’s 25yrs old. She makes $100,000/annually and has decided to contribute $10,000 to her Roth 401(k). We’ll assume she has a 30% tax on ordinary income (even in retirement).

- The W2 tax wages at $100,000 since she contributed $10,000 to her Roth 401(k)

- Her Tax will be $30,000 ($100k x 30%), which is $3,000 more than if she invested in a Traditional 401(k)

- The amount contributed to the Roth 401(k) is already taxed before the investment

- She can only withdraw money from the gains she made in her Roth 401(k) without penalty after the age of 59.5

- She can, however, withdraw her contributions at any time without penalty (since the money is already taxed)

- At the age of 65, the $10k she contributed at the age of 25 at 7% return now turns into a cool 15x nearly $150k

- No taxes will be paid on any withdrawal during her retirement years (after 59.5)

- There is no RMD (required minimum distributions). Melody can wait until she’s 80 to start withdrawing. At that point, the original $10k contribution now turns into nearly $450k

Which 401(k) is better?

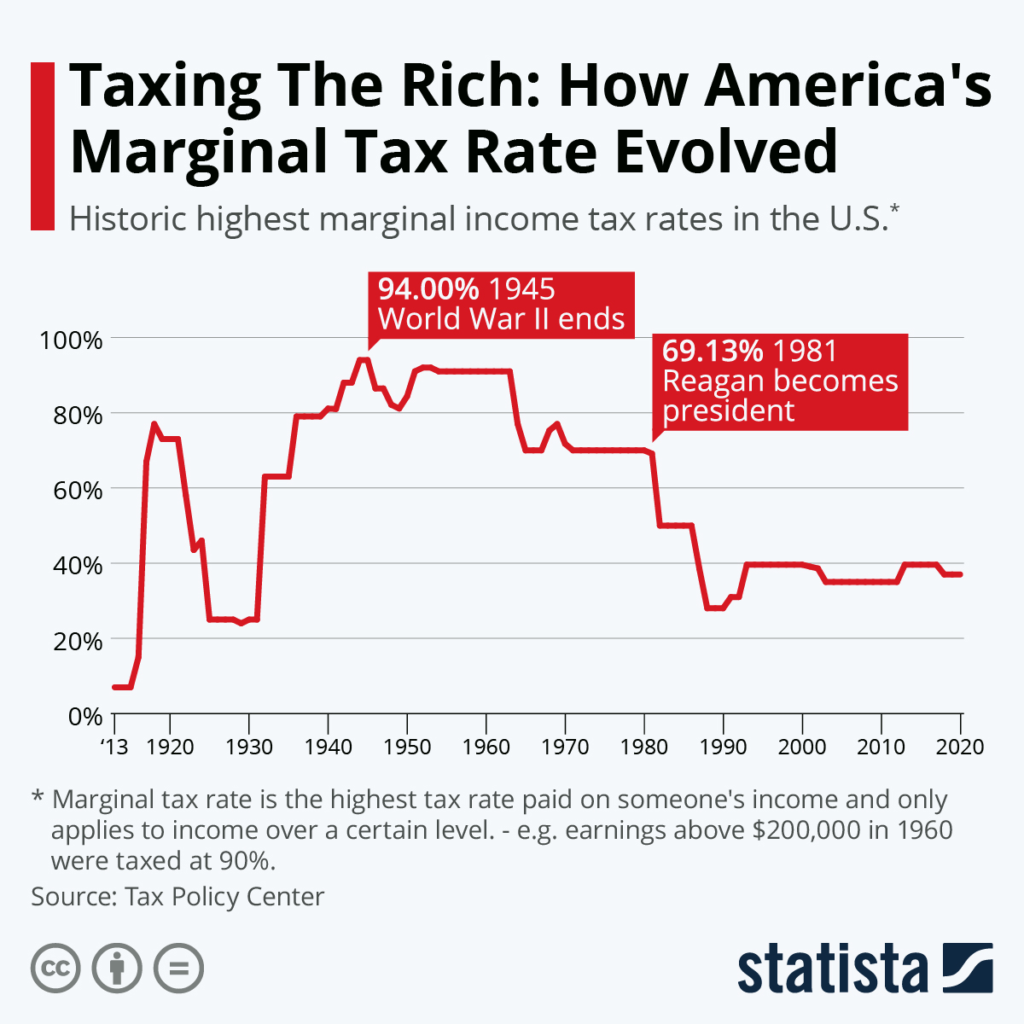

This is a difficult question to answer primarily because how do we know what taxes look like in the future? Currently, the highest fed tax rate is 37%, but did you know that from the 30s to the 80s, the highest fed tax rate was over 50%!

It also depends on how large your 401(k) withdrawals are as well as other sources of income (ie pension, IRA withdrawal, etc). The popular response is “Deciding between the two depends on your current and future tax situation.” My even more vague response is “It really depends.” If you’re confident you can really build up a huge retirement fund and are fine with a slightly less take-home pay now, go for the Roth 401(k). If you don’t believe in the US government and think they will raise taxes in the future, go for the Roth 401(k).

Employer Matching

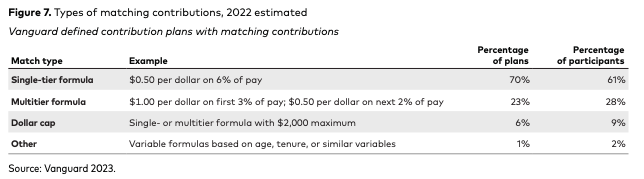

Employer matching, often referred to as a company match, is an incredibly valuable incentive offered by many employers as part of their 401(k) benefits package. It involves the employer contributing a certain percentage or dollar amount to an employee’s 401(k) account based on the employee’s own contributions. This essentially means that the employer is willing to match a portion of what the employee contributes to their retirement savings. According to a recent study from Vanguard, 95% of companies offer SOME type of company match.

We see this as an incredible benefit. In fact, we documented in the Hut Yee Way the importance of taking advantage of this as Step 2 even before paying off your debt. The most popular method of Employer Matching is the employer matching 50% of whatever you’re matching up to a certain percentage of your salary.

The company that I work for matches 50% of whatever I contribute with no maximum. Meaning if I contribute the maximum of $22,500, my company matches $11,250. For me, that’s a 50% return on day 1 of investments! Our thinking is that even if you have a credit card balance owing 20+%, the benefit of your company matching 50-100% is a much better use of your money.

Fund Selection

This may be the heart of how well your 401(k) performs throughout its life. Of course, as stated in our Disclaimer, we are not financial advisors so therefore we cannot tell you what to purchase. What we can provide are some general ideas of some popular portfolio strategies strictly for entertainment purposes. We’ve written about Popular Investing Portfolio Strategies using ETFs. Most 401(k) plans do not offer ETFs and typically only offer Mutual Funds, however, you will most likely be able to find a Mutual Fund that is very similar to the ETF you choose.

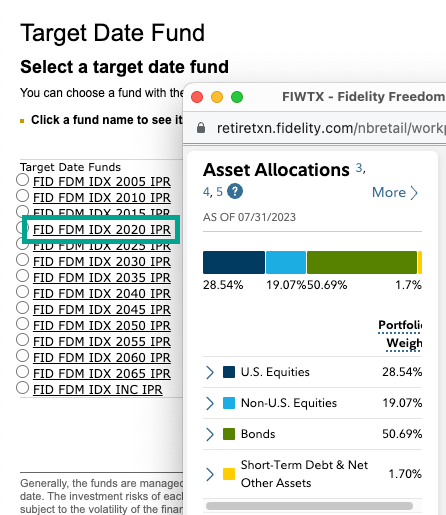

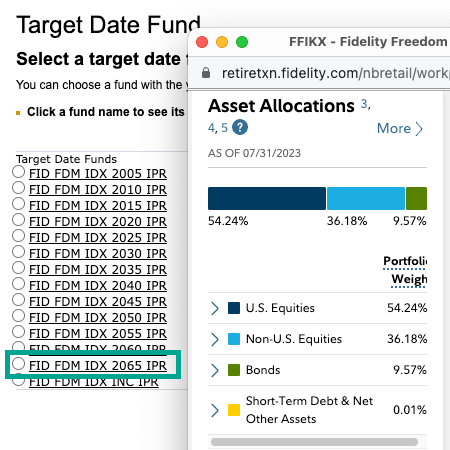

Target Dated Funds

If you want a set-and-forget strategy, this is a portfolio strategy for you. Target Dated Funds have risen in popularity accounting for nearly 40% of all planned assets. The concept behind target date funds is straightforward: as you approach your retirement date, the fund’s asset allocation becomes more conservative. This means that the fund gradually shifts from a higher percentage of stocks to a higher percentage of bonds and other lower-risk investments. The aim is to reduce the potential impact of market volatility on your retirement savings as you get closer to needing those funds.

To see an example using my 401(k) plan from Fidelity, if I chose the target date fund of 2020 (meaning I’m retiring around 2020) you can see the Bond allocation of over 50%

However, if you’re young and you chose the target date fund of 2065, you can see the Bond allocation of around 10%

This particular Target Date Fund strategy mimics The Bogelhead Portfolio that we’ve written about which involves the US Stock Index, International Index and Bonds.

Self Selection Portfolio

If you read our blog about Portfolio Strategies and decided on a particular strategy, you can most likely build it out with your 401(k) plan.

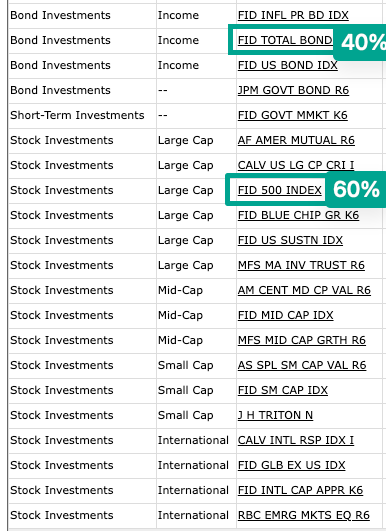

Let’s say you want to go with the conservative 60/40 strategy. Based on the selections available in my selection, I can easily build that out here:

Using the same funds, you can easily change the allocation to the Warren Buffett 90/10 Portfolio.

And finally, you can manually set the Bogelhead Portfolio by adding an International Fund. Unfortunately, there currently isn’t a way to easily mimic the Hut Yee Portfolio (at least for me) since there isn’t a Fund that is geared towards Dividends.

Fund Fees

Fees from Funds are something that most people underestimate when choosing funds. Every fund is managed differently so therefore the fees are often times vastly different. These fees typically range from 0.01% all the way to 2%. Having fees does not mean that you get an invoice in the mail. The fund itself on a regular cadence just deducts that percentage from the fund value. So in theory, you never see it. But as stated in our post about finding Low-Cost Index Funds, don’t underestimate the fees.

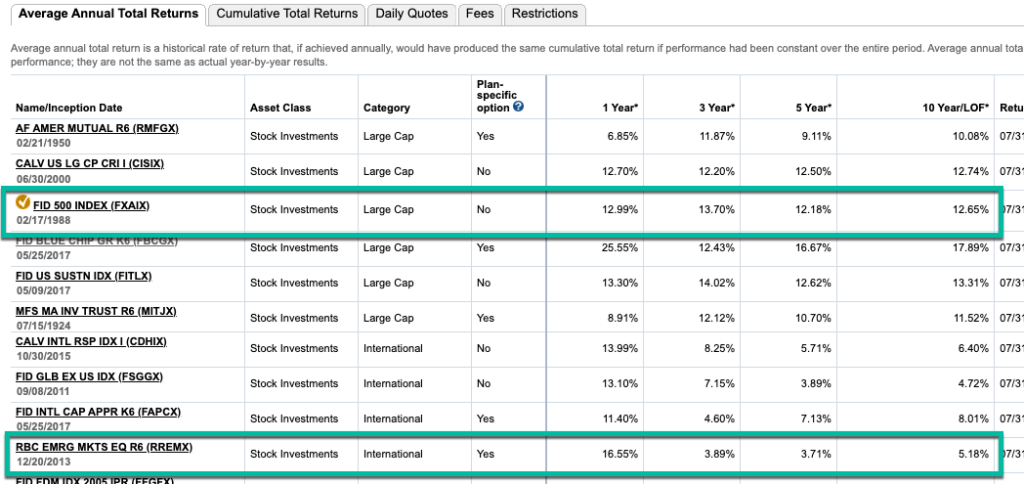

So using some of the funds offered in my 401(k) plan, I like to see the annual returns for the last 10 years or LOF (life of fund). In the example below I highlighted the FXAIX (S&P500 Index) as well as the RREMX (RBC Emerging Market). The S&P is averaging over 12% in the last 10 years while the RREMX is averaging a little over 5%.

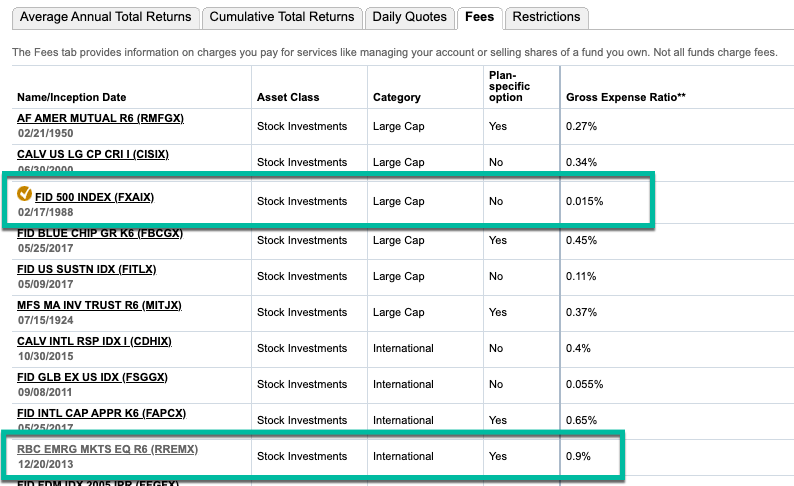

Now let’s look at the Expense Ratio for those 2 funds.

The FID 500 Index expense ratio is 0.015% ($0.15 per $1,000), while the RBC fund is charging a whopping 0.9% ($9.00 per $1000).

So if you were to invest $10,000 in the RBC fund expecting 5.18%, after 30 years you should be expecting the amount to grow to $47,000. But in actuality, the account is just $36,000. That 0.9% fee caused an $11,000 drag on the account. And that’s just 1 year of investments, imagine contributing to that fund for 10-20 years. You’re not only losing that money from your account, you’re also losing the opportunity to compound that money over time.

This is why having an understanding of the fees is so vital. A general rule of thumb is to select funds that have an expense ratio of 0.0x%. This is also another reason why we love the S&P500 index funds.

In case you’re wondering, the expense ratio for the Target Dated Funds for my plan is 0.08% ($0.80 per $1000).

Takeaways

By understanding the nuances of 401(k) plans, their benefits, and the various considerations involved, individuals can make informed decisions to ensure a more secure and comfortable retirement. From choosing the right plan type to optimizing contributions and minimizing fees, navigating the world of 401(k)s is a crucial step in securing your financial future.

We would like to emphasize that we are not financial advisors. The information provided on this website and in our YouTube videos is strictly for educational purposes and represents our personal opinions. To ensure the most appropriate financial decision for your specific needs, it is essential to conduct thorough research and, if necessary, consult with a licensed financial advisor. It is important to acknowledge that all investments involve inherent risks, and there is no guarantee of success in generating, saving, or investing money. Additionally, there is a possibility of experiencing losses when investing. It is crucial to exercise prudence, make informed choices, and independently verify information.